UPDATE: Biotech Index, ETF’s reach 61.8% Fibonacci Retracement of Feb-Apr Decline

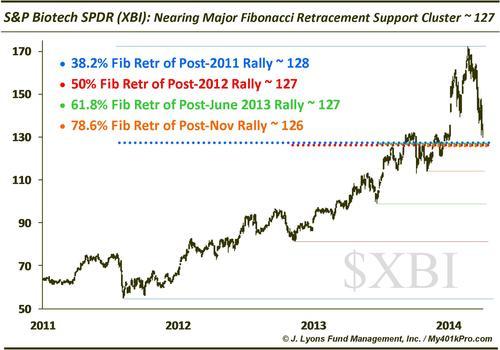

On April 9, we pointed out a key Fibonacci Retracement cluster of support on the S&P SPDR Biotech ETF, $XBI (also generally corresponding with similar levels on the Biotech Index, $BTK, and iShares Nasdaq Biotech ETF, $IBB.):

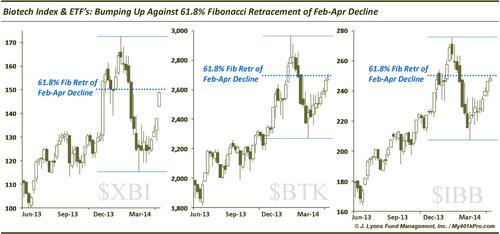

After dancing back and forth a bit on that level, the $XBI and biotech related securities did in fact bounce from the general area. On April 22, we tweeted that the $BTK and biotech ETF’s had reached the 38.2% retracement level of their selloff but that they had a good shot at reaching the 61.8% level. Over the past 2 days, they have indeed reached that mark:

So what next? We’ve no idea. Perhaps biotech stocks are simply in the new normal process of V-bottoming on their way back to new highs since apparently no market ever sells off anymore for more than a few weeks. Sarcasm aside, if these biotech issues are in the post-bubble-popping phase of trading, you won’t find us anywhere near the long side of them. Buying bubbles that have popped is not recommended…at least not for a few years. (Note: we do not throw the term “bubble” around loosely.) Nothing we publish on this blog is a recommendation to buy or sell anything, but we would think that Investors who were stuck holding the biotech bubble when it popped should be pretty happy getting back to the 61.8% retracement level. 6 weeks ago, we may have called it their best case scenario.