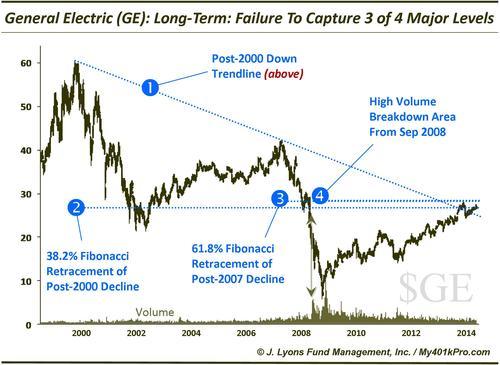

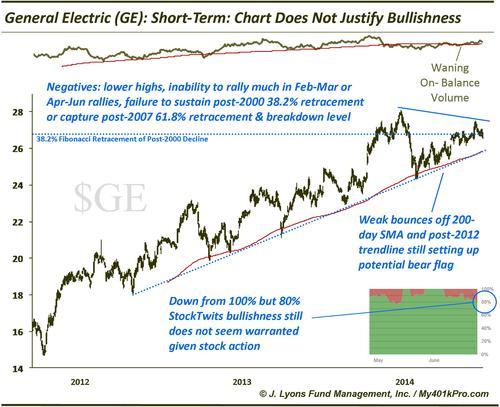

UPDATE: General Electric $GE: Long-Term & Short-Term Charts Still Don’t Warrant Bullishness

Our April 17 ChOTD looked at General Electric ($GE) from a long-term and short-term perspective. Our conclusion was that given the fact that it was contending with major resistance levels from a long-term perspective and was failing at such levels on a short-term perspective, the widespread bullishness was not justified. Upon revisiting the charts, our conclusion remains the same (or, as they might say on Wall Street, “we reiterate our blah blah blah rating”).

Long-Term:

Short-Term:

Specific concerns are noted on the charts. If the stock is indeed a bellwether for the market or the economy (not saying it is or not), its poor action may be a broader red flag. At a minimum, given its large weighting in industrial ETF’s (top-weighted in the Industrial SPDR $XLI at > 10%), caution there may be warranted.