Semiconductors: From Leaders To Laggards?

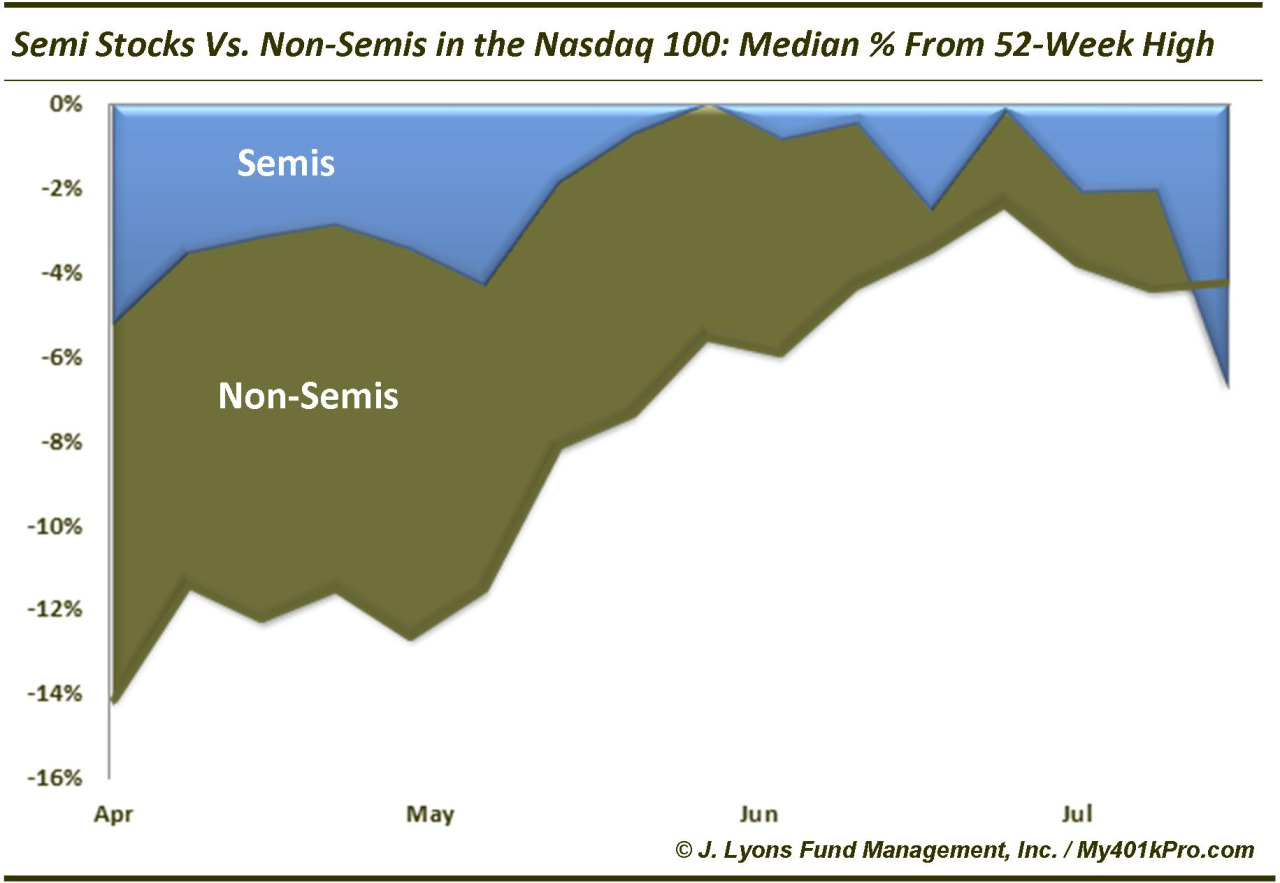

Our July 1 Chart Of The Day focused on the fact that the strong run in the Nasdaq 100 was being substantially driven by the semiconductor stocks. We noted that while the NDX was up about 4% over the previous 4 months, it was largely due to the performance of the semis. The average semi was up almost 13% during that time while the average non-semi was barely above the unchanged mark. Furthermore, the median semi stock was essentially at a 52-week high while the median non-semi was about 3% off its high.

Well, like pennant contenders’ lineups near the trade deadline, things in this market can change quickly. After maintaining a comfortable spread over non-semi stocks (nearly 10% at one point in April), the median semiconductor stock is now further from its 52-week high than the median non-semi. The decimation in names like Sandisk SNDK and Xilinx XLNX may not have been readily apparent from the semi indices, thanks to the strong performance of the giant of the sector, Intel INTC (20% weighting in some funds and indices).

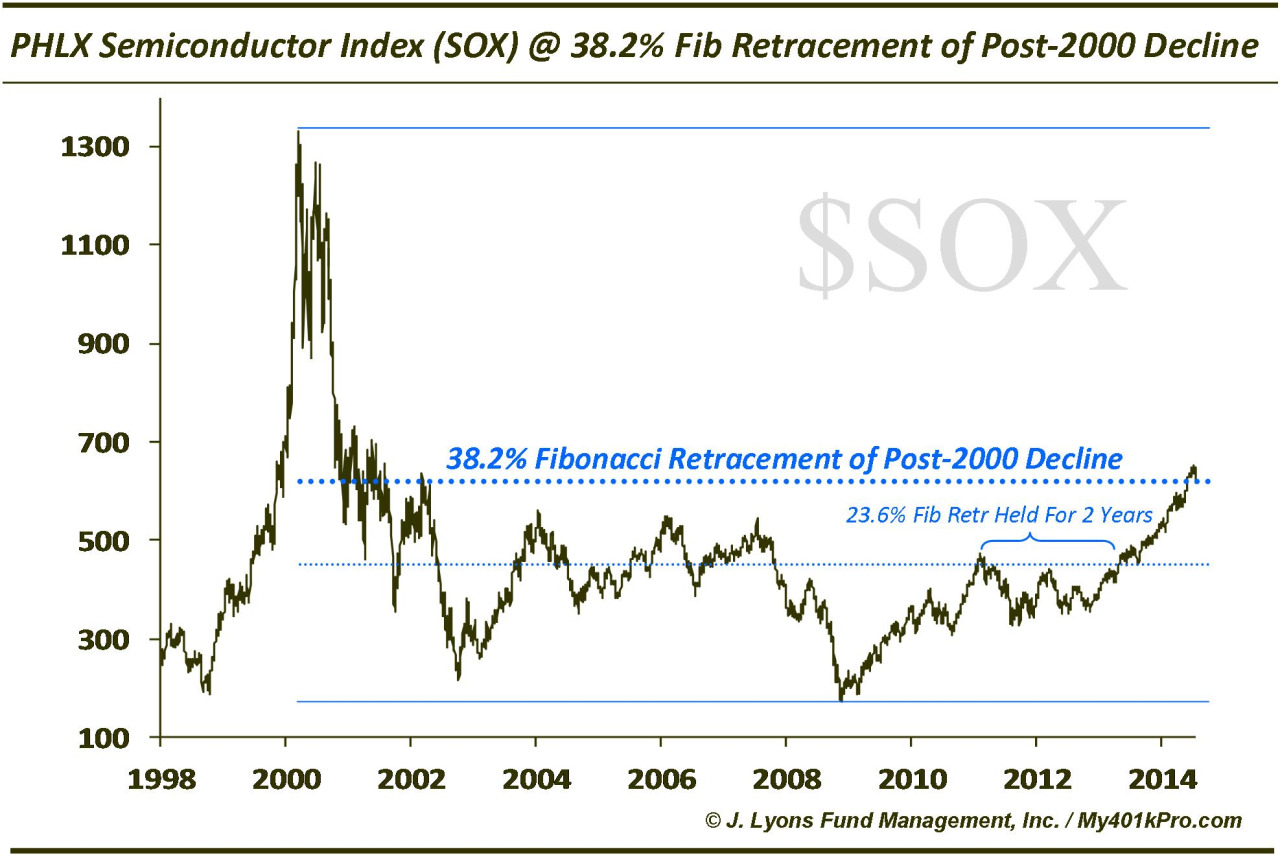

And while INTC has put in yeoman’s work in keeping the indices afloat, the deterioration across the sector comes at an interesting spot on the Philadelphia Semiconductor Index (SOX). As we posted on June 11, the SOX recently traded up to the 38.2% Fibonacci Retracement of its 2000-2009 decline (it actually broke above for a few weeks before coming back down to it). Just as the 23.6% Fibonacci Retracement held the SOX in check from early 2011 to early 2013, this area poses a challenge for the index, in particular with various components breaking down hard.

So should investors be concerned about the developing semiconductor weakness? Maybe, maybe not. As we noted in the July 1 post,

With fewer areas and stocks strongly participating in the rally, the strength in semis is masking that condition [underlying weakness]. Should the semiconductors begin to weaken, it could have negative implications on the Nasdaq 100 as a whole. Then again, the white knight of stock rotation may once again come to the rally’s rescue as a new leader takes over.

If Intel can hold up (no signs of weakness there; possible resistance higher near 36.50), perhaps the semiconductor sector can regain its footing. That said, broad participation is always preferable when investing in any market segment. If nothing else, it provides for more margin of error. If Intel does begin to tire, there are fewer semi components trading well right now to support the sector. Therefore, the developing weakness will be a major concern for the sector and, barring rotation to another leadership group, concern for the broader Nasdaq market as well.