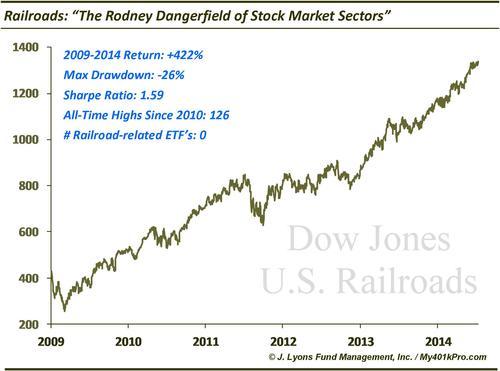

ChOTD-7/15/14 Railroads: “The Rodney Dangerfield of Stock Market Sectors”

Today’s ChOTD spotlights a sector that has been one of the best performers of the current cyclical bull market – and also one of the most underappreciated: Railroads.

The chart isn’t complicated, nor is this post. We just thought that given the run that the railroad sector has been on the past 5 years, we wanted to pay our respects while the run was still alive.

As the stats on the chart indicate, the sector is up over 400% since the low in 2009. And though it did suffer a drawdown of -26% in the 2011 market correction, that is relatively modest given its return over the period. That is borne out by the its Sharpe Ratio, a measure of risk-adjusted return, of 1.59 over the 5-year period. The railroad rally has been so smooth, it’s almost as if it was on – rails! (sorry)

Furthermore, the sector recovered its 2011 losses very quickly and was at a new high just 3 months after its low. Speaking of new highs, the DJ Railroad Index has made no less than 126 new all-time highs since first hitting one in late 2010. That’s about once every 7 days for almost 4 years!

Yet, despite this monster run, the railroad sector has gone relatively unappreciated. So much so that there are still exactly ZERO ETF’s related to it. Perhaps there just aren’t enough railroad stocks to make it profitable or worthwhile? We don’t know the answer but we do know that there are ETF’s on the smart grid, robotics and Singaporean small-caps so…come on.