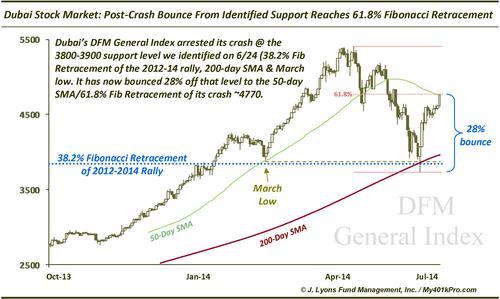

UPDATE (Mission Accomplished): Dubai Stock Mkt Post-Crash Bounce Reaches 61.8% Fibonacci Retracement (+28%)

On June 24, we posted a chart showing the Dubai Stock Market crashing. We also noted that it was approaching its first major support level around 3800-3900. Notwithstanding one temporary intraday break and reversal, it held that precise support level. On July 3, we noted that the DFM General Index hit the 38.2% Fibonacci Retracement of the crash and that the next target was the 4770 level, representing the 61.8% Fib Retracement level, as well as the 50-day SMA. Today, it traded up to 4766.86. We’ll call that “mission accomplished”.

A 28% return in 3 weeks isn’t bad – hopefully some readers were able to take advantage of it. The iShares UAE ETF, by the way, was up 14% over that period.

While we will continue to monitor the Dubai market as the post-crash process plays out (next step: retest?), we are closing the chapter on this story for now.