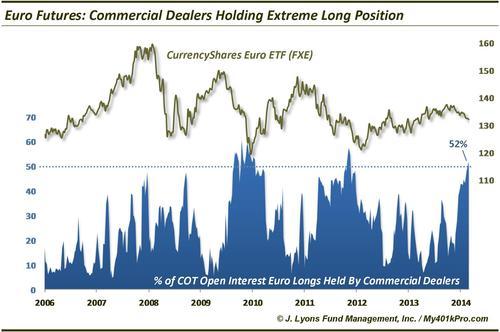

Euro approaching support with dealers holding substantial long positions

We take a step away from equities today to focus on the Euro currency. The Chart Of The Day that we posted earlier on Twitter and StockTwits looked at the Commitment Of Traders positioning in the Euro. The impetus for posting the chart is the present substantial long position among the commercial dealers.

The chart measures the percentage of open interest longs in Euro futures that are held by commercial dealers. Once again, the dealers are necessarily on the other side of futures trades from small and large speculators. While the speculators are made up largely of hedge funds and commodity funds, dealers typically hold the positions as hedges. The speculators are mostly trend-following entities that build up positions in the direction of the trend in the commodity. Conversely, since dealers take the other side of speculators, their position naturally grows counter to the trend in price (i.e., they get longer as price trends lower) until their positioning hits an extreme. At that point, price is susceptible to a reversal.

Dealer positions are at that point now. They currently hold over 50% of all open interest long contracts. This is the approximate level from which the Euro reversed downtrends in 2009, 2010 and 2012. In 2009, dealers’ long % of open interest reached 48% when the Euro bottomed. In 2010 and 2012, the percentage reached closer to 60% before the Euro reversed higher.

We will hasten to add that in 2010 and 2012, the Euro did not bottom until several months after the extreme dealer long position was first attained. Indeed, it was only after their long position began coming down that the Euro put in a low and started to rally. Therefore, while conditions are in place to stage a reversal, it may be best to watch for signs of a reversal in both dealer longs and the price of Euros before calling a bottom.

As far as price levels to watch for, we have updated a chart of the CurrencyShares Euro ETF (FXE) that we posted on July 17. In that post, we noted that if support levels in the mod-133’s did not hold, further weakness was likely down to the 130.50-131.00 level. That support did not hold and prices have dropped steadily ever since. FXE is currently about 1% away from that next support level just below the 131 level.

Perhaps a drop to that level, marked by the 38.2% Fibonacci Retracement of the 2012-2014 rally and 61.8% Fibonacci Retracement of the 2013-2014 rally, will coincide with a reversal in the dealers’ COT positioning and provide a catalyst for a turn higher in the Euro. It should at the very least arrest the decline in the Euro in the short-term. Should the FXE suffer a serious breach of that level, it would open up a drop to around 126.50.

More from JLFMI.