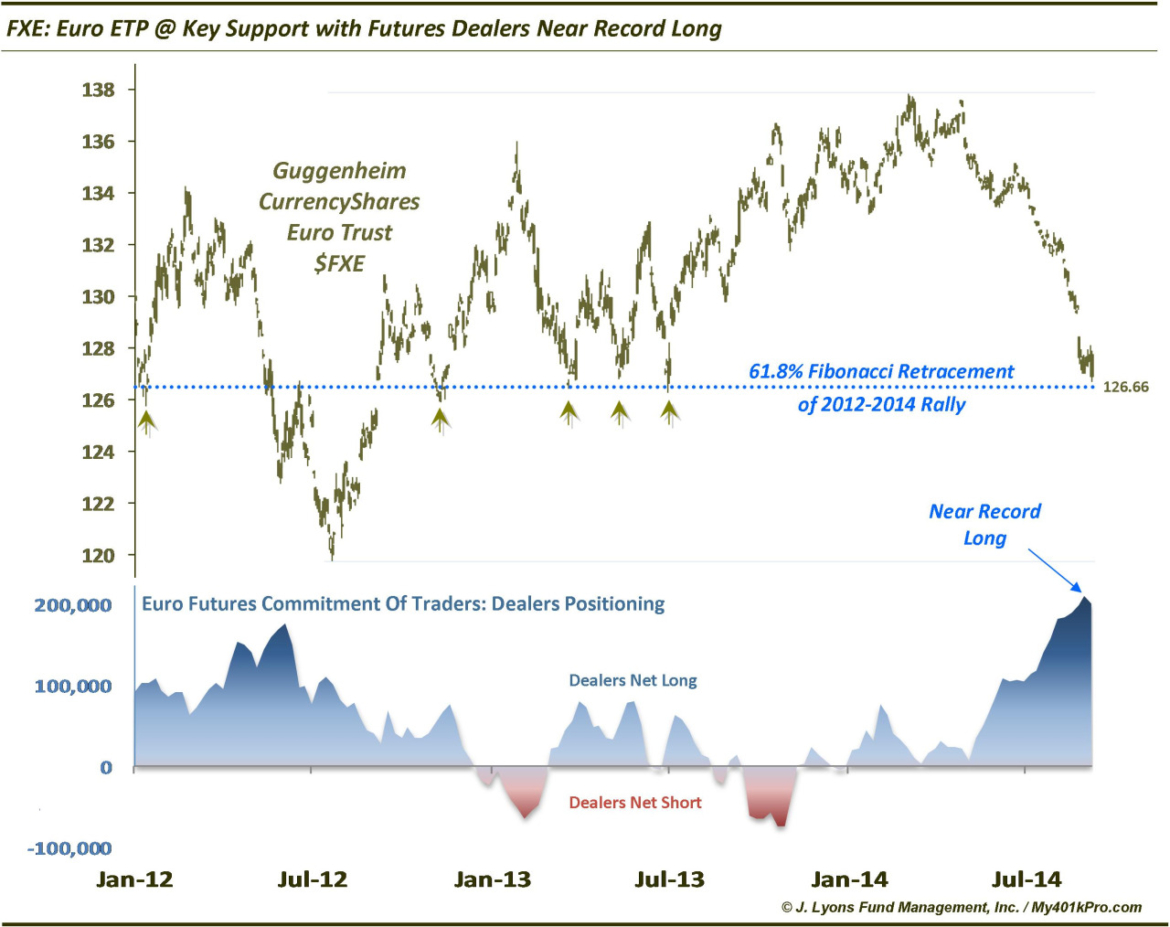

Euro at Key Support Now with Futures Dealers Near Record Long

On August 12, we noted that the Euro, via the Exchange Traded Product, FXE, was approaching key preliminary support just under 131. At the time, dealers in Euro futures were holding a substantial net long position (again, the dealers are typically positioned correctly at key turning points in the futures markets). As the Euro has continued to weaken, FXE sliced right through the 131 level. In our post, we suggested that if it could not hold the 131 level, it would open up a drop to around 126.50. It is approaching that level now.

In the post-Fed reaction yesterday, FXE traded as low as 126.72. The test of the 126.50 level is officially on. To reiterate, this area is marked by the 61.8% Fibonacci Retracement of the Euro’s rally from 2012 to 2014. This area also marked short to intermediate-term lows on no less than 5 occassions in the past 2+ years. There should be ample support there for at least a bounce.

Additionally, over the past month the dealers’ net long position has continued to grow. They are now net long more than 200,000 contracts for only the 2nd time in history. On the other side of the ledger, speculators are obviously net short at near record levels. A bounce from the key support level here could spark a significant short-covering rally.

Lastly, though we do not rely on seasonality as a concrete input into investment decisions, we are now beginning the historically most bullish time of the year for the Euro currency. The months spanning September to December have, on average, been the most positive for the Euro. Again, this is simply a slight tailwind (perhaps) within this Euro bounce scenario.

So how much of a rally should one look for? As always, we won’t put constraints on any move, should one occur. We’ll simply let prices instruct us. That said, recent action may give us a clue as to whether a possible rally may be just a bounce or something bigger.

Unfortunately for bulls, the failure at the 131 level opened the door to current prices around 126.50. This means a failure to form a higher low, post-2012. With a clear pattern of long-term lower highs, the inability to maintain a higher low means the odds of breaking that longer-term downtrend were just diminished. Therefore, while we see a good chance of a bounce in the near-term, it quite likely will be just that, a bounce. Longer-term, the current lateral low means a high likelihood of eventually testing the 2010 and 2012 lows around 120. Furthermore, given the momentum in the dollar in breaking out of its long base, it likely has more upside, ultimately. That bodes poorly for the Euro.

For now, however, we are on the lookout for a bounce in the Euro ETP, FXE, from key support at 126.50. Current futures positioning should provide support for this bounce, along with seasonality. A short-term target would be the previous breakdown level around 131. This level also represents the 38.2% Fibonacci Retracement of the 2014 decline. If FXE cannot hold 126.50, the 2010 and 2012 lows near 120 will be in range.

_________

More from Dana Lyons, JLFMI and My401kPro.