Rates ARE Rising: 5-Year Yield Highest In Over 3 Years

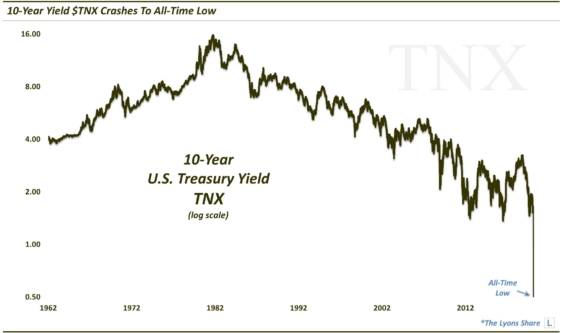

Fellow contributor and stats guru Ryan Detrick recently reminded me of the Bloomberg survey at the beginning of the year in which 67 of 67 economists predicted higher rates in 2014. Now, the year isn’t over but with 10-year Treasury yields down 44 basis points (14.5%), it’ll take a heck of a bond rout in the next three and a half months for consensus to avoid being wrong.

If they had been talking about the 5-Year yield, however, things would be a little different. The yield on the 5-Year Treasury Note closed 2013 at 1.75%. Yesterday, it closed at 1.77%. It’s not much, but 5-Year rates are up. Furthermore, the 5-Year closed last week at 1.82%, the highest close in over 3 years. (Contributor Chris Kimble also noted this development as well as rising 2-Year yields here.)

While there has not been follow-through above that level yet, 5-Year yields have been forming a bullish Ascending Triangle for the past 12+ months. The beginning of that triangle was formed by the spike associated with the “taper tantrum” in May to June of last year. While 10-Year rates have lost 50% of their taper tantrum gains and the 30-year, 75%, the 5-Year has not budged, instead forming the triangle which it is now threatening to break above.

Should the breakout occur, the upside target stemming from the triangle formation would be roughly 2.25%. That level would also correspond with the 2010 highs as well as the 23.6% Fibonacci Retracement of the 1995-2012 decline and the 38.2% Fibonacci Retracement of the 2007-2012 decline.

What is the takeaway from this? Besides the fact that 5-Year rates look like they are about to break out to the upside, much of the nation’s and world’s investments and financial posture is predicated on low rates. Even if the Fed and other central banks leave short-term rates fixed at 0% (or less), a rise in longer term rates could pose a significant problem to borrowers – whether it be sovereignties monetizing their debt or investors using low rates to leverage their positions.

At a minimum, it may be a good time to think about locking in 5-year loans or avoiding 5-year ARM’s.

__________

More from Dana Lyons, JLFMI and My401kPro.