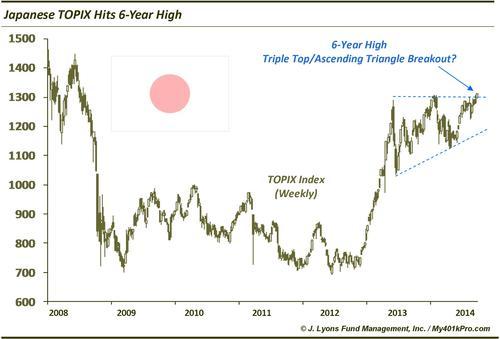

Stocks Hit 6-Year High In…Japan?

Quick, name the country whose stock market hit a 6-year high yesterday. OK, besides India…and Argentina. Believe it or not, it is Japan, at least as measured by the TOPIX Price Index. The TOPIX is a broader index than the more popular Nikkei 225 which is still trading below its high set around the beginning of the year.

Yesterday, the TOPIX arguably broke above a triple top just above 1300, marked by closes in May 2013 and January and July of this year. Those high closes also marked the upper bound of a possible 16-month Ascending Triangle. Should the breakout be successful, a standard measure would suggest a possible target around 1550 (which is also the 38.2% Fibonacci Retracement of the 1989-2012 decline).

It remains to be seen if the weekly close tomorrow will hold above this level. If it does, longs based on this breakout can be established. A weekly close back below the 1330 level would be a natural stop loss point.

There are a few reasons why we are a little skeptical of this breakout (besides 25 years of non-stop disappointment doled out by the Japanese stock market). For one, considering the yen collapse the past few weeks, it is somewhat surprising the TOPIX hasn’t made an even stronger move. While we do not like to apply causality to market moves, considering the recent correlation it is not a stretch to link the move higher in Japanese stocks to the weakening yen. In addition, several other indexes have not confirmed this new high in the TOPIX, including the Nikkei 225 and various small cap indexes. Lastly, it would be a bit premature of a triangle breakout. Typically we like to see a few more touches of the upper and lower bounds and see the index approach the “point” of the triangle a little closer before the breakout transpires.

Nevertheless, we have learned to take moves at face value because, as they say, price is truth. And the TOPIX Price Index is at a 6-year high.

_______

More from Dana Lyons, JLFMI and My401kPro.

“Fuji” photo by Janne Moren.