Smart Money Decreases Crude Oil Shorts By Record Amount

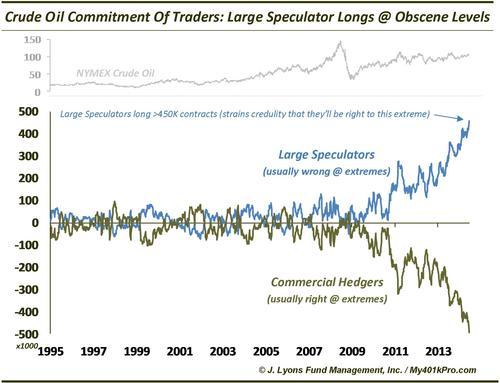

On July 3, our Chart Of The Day showed the net positioning in Light Sweet Crude Oil futures among the various groups tracked by the CFTC. As a refresher, here are the 2 groups we featured in our chart as well as primer on their historical trading profile.

Commercial Hedgers are typically involved directly in an industry reliant upon a particular commodity. Most of the time, they are truly “hedged” against the commodity and, since they are most intimately familiar with the commodity, are considered the “smart money”, at least when the market hits an extreme

Large Speculators are by and large commodity pools that exist mainly to trade the market long and short. These funds are normally trend-following entities and while they can be on the correct side of an extended trend, at extremes they are considered “dumb money” as they are typically “off-sides”

Here is the chart we posted in July.

At the time, we opined that the record net short position (and massively so) held by commercial hedgers – and conversely record net long by the large speculators – did not bode well for the price of oil. As we mentioned in the chart, to us it strained credulity that the large speculators would be right with respect to their obscenely large net long position. The imbalance was so skewed that it led many to wonder if there was still value in the data or whether there had been some structural change that rendered it irrelevant. Well, it appears that it is still relevant and that our skepticism toward the speculators’ long position proved well-founded.

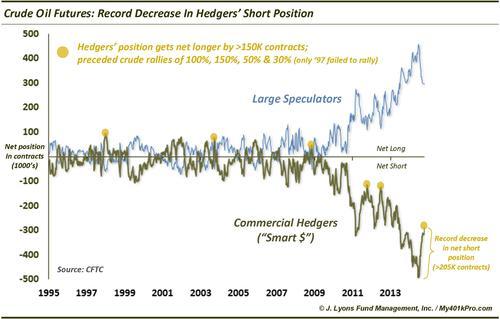

Over the past 4 months, crude oil has dropped some 30%. With that drop has come a large reduction in the number of short futures contracts held by commercial hedgers – in fact, a record reduction. The hedgers have gone from a net short position of nearly 500,000 contracts at the end of June to less than 300,000. This net reduction of more than 205,000 short contracts is the largest in history. Here is the updated positioning chart.

As is evident, hedgers have significantly pared their shorts and speculators have significantly pared their longs. That said, on a historical basis, their respective positions are still extreme. Does that mean there still may be much further downside to the oil decline? It is possible, but we would not count on it, at least in the near to intermediate-term.

While the overall futures positioning is still greatly skewed from a historical basis, on a shorter-term rate of change basis, the skew has been repaired to a large extent. This should not be ignored. For while the still-large hedger short position suggests the long-term cycle may still be lower, there are shorter cycles within the longer cycles. And these short-term cycles can lead to significant counter-trend moves on an intermediate-term (i.e., months) basis. Even if one is correct in forecasting, hypothetically, a long-term decline, a substantial short-term rally can make such a bet financially difficult (or impossible) to maintain.

Consider the current circumstances. Hedgers have already cut their net short position by a record 205,000 contracts. Historically, there have been just 5 other occasions in which hedgers have gotten “net longer” by at least 150,000 contracts. Those dates were in December 1997, September 2003, November 2008, October 2011 and June 2012. The last four of those such occasions led to intermediate-term rallies in crude oil of roughly 105%, 150%, 50% and 30%, respectively. Only the 1997 instance did not lead to a rally.

So while the absolute net short position among hedgers is still at a historical extreme, we do not believe the record reduction should be ignored. Back in early July, some wondered about our downbeat view on crude prices based on the CFTC positions. While the hedgers were a record net short, they had been near-record short for years. What was the difference at that particular time? It is an understandable argument, even as it is applied to our less-bearish stance on oil prices now. That is why the shorter-term cycles and rate of change need to be considered. In early July, the short-term rate of change in hedger shorts was extreme in addition to the bearish bigger picture. Conversely, after the recent record cut in the level of hedger short positions, we have a hard time being overly bearish on crude oil prices right now.

Sure, prices can continue lower. Indeed, that is the trend and should be respected first and foremost as price rules. And considering the positioning extremes among futures groups the past few years, we can expect extreme moves in the price of the crude. However, the shorter-term improvement in positions should not be ignored in our view. And considering the record recent hedger short-covering, at a minimum, stop levels should perhaps be tightened for those short the commodity.

________

“Landscape with Barrel” photo by Carlos Rincón.

More from Dana Lyons, JLFMI and My401kPro.