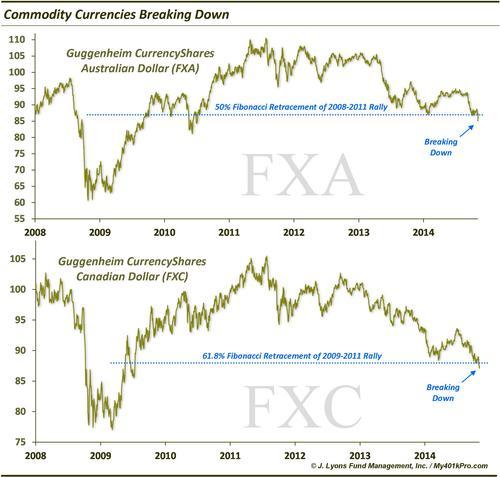

Commodity Currencies Breaking Down

One of the casualties of the ongoing rout in commodities has been currencies in countries whose economic output is substantially tied to commodities. Specifically, Australia and Canada have seen their currencies weaken substantially over the past 4 months. And while exporters in those countries may welcome the development (not to mention, central bankers), it is not a positive reflection on the respective economies, particularly given the currency sand-bagging going on around the world.

The aforementioned weakness is evident in the ETF’s tracking the Australian Dollar (FXA) and Canadian Dollar (FXC), Earlier in the year as commodities were moving to the upside, we noted the possible short and long-term bottoms being put in in the FXA and the FXC. The short-term bottoms did transpire as the ETF’s moved up about 5% and 4% respectively after our posts. However, as commodities turned south, the long-term turn higher did not materialize. Now, we are seeing clear evidence of these currency breakdowns underway.

The Australian Dollar ETF, FXA, broke down to a 4-year low yesterday. In doing so, it broke below the 50% Fibonacci Retracement of the 2008-2011 rally, which had held as support in January of this year. Similarly, the Canadian Dollar ETF, FXC, broke to 5-year lows in the past few days. It also broke the key 61.8% Fibonacci Retracement of the 2009-2011 rally which had held as support in March. These breakdowns open up these currency ETF’s to possible significant downside. Make no mistake, this is a very bearish development.

Of course, that being said, especially given recent market tendencies to produce false breakdowns and breakouts, traders must be on alert for a possible reversal back up. For, as strong a bearish signal as this breakdown is, it would be equally as bullish a signal if the ETF’s are able to reverse back above the breakdown areas. Given some of the washout signals we’ve discussed recently in some of the commodity markets, we must be especially alert for such a reversal.

The breakdown levels on the ETF’s will be the tell. Such levels are approximately 86.90 on the FXA and 87.70 on the FXC. Below those levels, the risk is to the downside. Above there, the possibility of a false breakdown and a reversal up is in play.

________

“Sorry, we no longer accept Canadian coins” photo by Jonathon Colman.

More from Dana Lyons, JLFMI and My401kPro.