Historic Flame Out In Energy Stocks

Energy stocks have had an extremely rough go of it lately. In the past few months, they have been on the receiving end of a double dose of negative influences: the September-October stock market sell off and the ongoing commodity rout. And by an “extremely” rough go, we mean literally extreme.

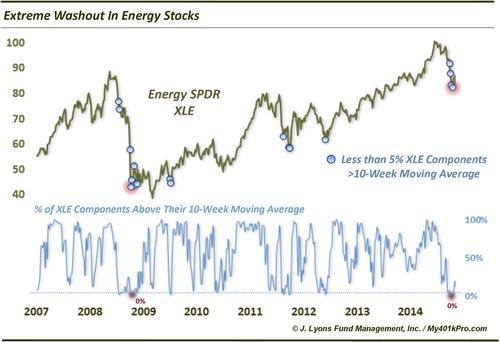

Monitoring the action of the components of the largest energy ETF, the Energy Select Sector SPDR (XLE), we see that they experienced a washout that has only occurred one other time in the past decade. Over the past few weeks, every one of the components was trading below its 10-week (approximately 50-day) simple moving average. The only other time this occurred was in the depths of the 2008 financial crisis/oil implosion.

Looking at times when the % of XLE components above the 10-week moving average dropped below 5%, we notice a strong tendency for an intermediate-term bounce. Since October 2008, the average maximum 3-month gain (on a weekly closing basis) following these readings was +17% versus an average maximum drawdown of just -3%. The 3 unique occurrences since 2009 produced an average max gain of 21% versus an average drawdown of -2%. Don’t know about you but we’ll take a return to risk ratio of over 10:1.

The only instance that did not see at least a short-term bounce was in July 2008 as the XLE, and the price of oil were just coming off of their meteoric, bubbly highs. Obviously, there was no relief from that selling pressure until October when the % of components above the 10-week MA dropped to 0%.

It could be argued that we are in similar circumstances with the XLE coming off of another meteoric rise. However, at least in terms of the commodity, oil is nowhere near extended or overbought. In fact, it is just the opposite. Even then, in October 2008, when the reading hit 0% a couple times, the XLE managed a 12-18% bounce, though temporary.

It is true the XLE is up some 6% already off of the October weekly low and further upside may be limited. However, given the washout in the price of oil and the upside momentum in the general stock market, we could see further potential upside toward the 17-21% mark over the next few months.

________

“Up in smoke” photo by Nathanael Coyne.

More from Dana Lyons, JLFMI and My401kPro.