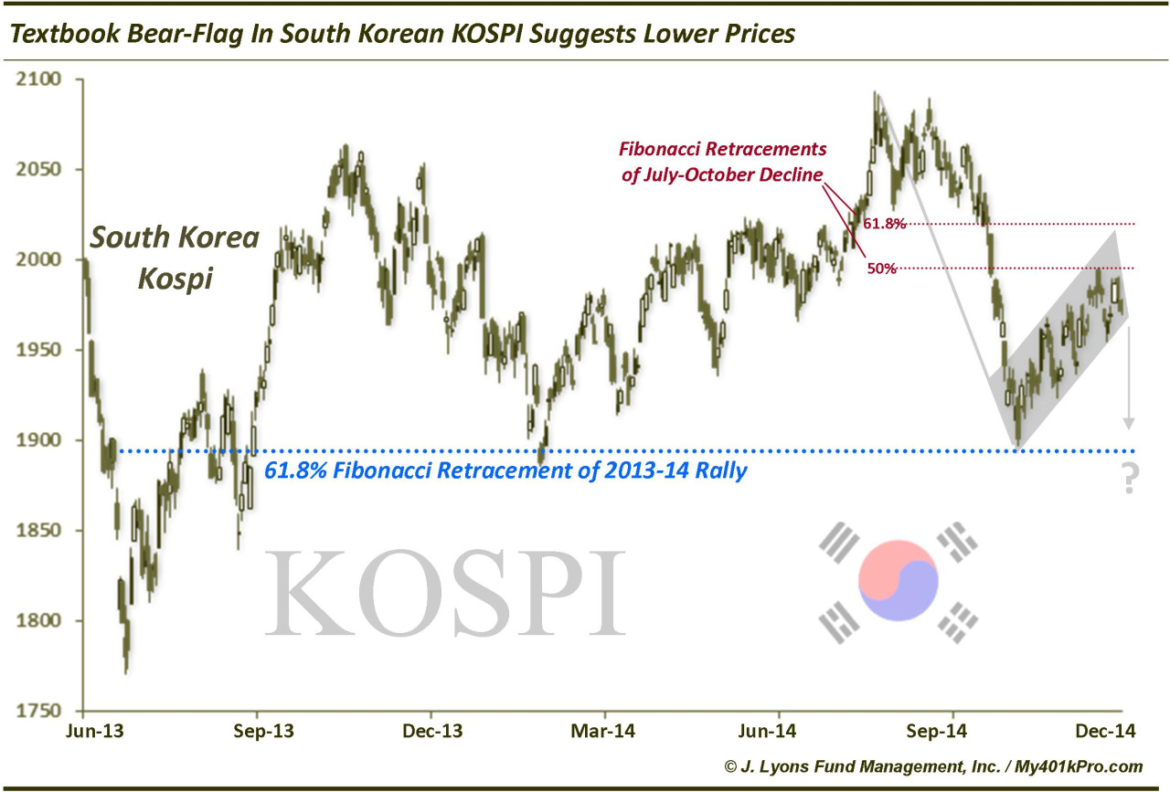

KOSPI: Korean For “Bear Flag”?

While some of the Asian stock markets have been on fire lately (e.g., Japan, China), the South Korean KOSPI Index has been a noticeable laggard. Down about 2% on the year, the KOSPI could not muster any follow-through to its 3-year highs made in July. In fact, the index has collapsed since, dropping almost 10% at its low point in October. This relative weakness has coincided, not coincidentally, with actions by other central banks in the region aimed at devaluing their currency. It appears that South Korea’s weak attempt thus far at engaging the devaluation battle has not done its stock market any favors.

Whatever the reason (if one must find one), the action in the KOSPI is not encouraging. Following the drop from July to October (which stopped precisely at the 61.8% Fibonacci Retracement of the 2013-2014 rally), the Index has only managed a weak, shallow bounce. This formation is a textbook “bear flag”. This is a continuation pattern that the “textbook” suggests should resolve itself to the downside eventually, i.e., continue its down trend.

Should the bear flag implications pan out, the first target would be a retest of the October lows just below 1900. An undercut of that area would not be a surprise and the Index would quickly hit the up trendline connecting the 2010, 2011 and 2013 lows, currently around 1870. That may provide a springboard for a better bounce.

Above, the bear flag could continue intact up close to the 2020 area. This area signifies both the breakdown level from October and the 61.8% Fibonacci Retracement of the July to October decline. Sellers, or short-sellers, might find that a prime spot to target, should the KOSPI get there.

*Not a recommendation.*

________

More from Dana Lyons, JLFMI and My401kPro.