Deflationary Pressure Is Building

Today we take a rare foray out of the financial markets and into economic territory. With the race to debase currencies by central banks around the world, inflationary, or even hyper-inflationary, concerns have for years been at the fore of media outlets, both the mainstream and the infomercial variety. However, the data clearly points to inflation’s evil counterpart, deflation, as the main threat at this time (this post has nothing to do with the Patriots). And particularly given the outright collapse in commodity prices over the past 6 months, this deflationary pressure should be patently obvious at this point.

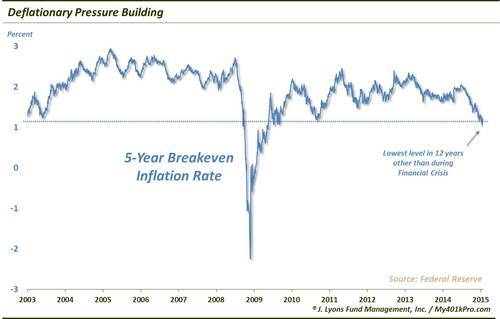

Commodity prices aside, one data series that economists watch as an indicator of inflation, or lack thereof, is called the “5-year Breakeven Inflation Rate”. The 5-year Breakeven Inflation Rate is simply the difference between the 5-Year Treasury Yield and the yield on a 5-year inflation protected security. If inflation is rising or elevated, inflation protected securities will rise as well, pushing down their yields. Thus, the Breakeven Rate will rise indicating the higher level, or perceived level, of inflation.

Last week, the 5-Year Breakeven Inflation Rate hit a level of 1.05%. This is noteworthy as it’s the lowest level in the Federal Reserve’s database going back to 2003, other than during the financial crisis.

So what’s the big deal about deflation? Aren’t lower prices good for consumers? Well, we’re not economists…which may help as we attempt a brief explanation of why deflation is typically an unwelcomed development, and why those in financial seats of power are so deathly afraid of it.

In general, there are two types of deflation. One comes as a result of factors that allow for the supply of goods to be manufactured or extracted at a cheaper cost to producers. In other words: higher productivity. Higher productivity, ususally through technological advances, can allow goods to be produced cheaper and sold to the public at a cheaper cost, without a decrease in operating margins. Therefore, consumers reap the benefits of cheaper prices and producers still make the same profits. While higher productivity can result in lower employment, it typically coincides with strong economic growth as consumers see better affordability and companies are enjoying strong profitability. Therefore, while some industry-specific productivity may decrease jobs, overall strong growth tends to produce increased jobs elsewhere in the economy.

Demand-driven deflation is another story. In this scenario, cheaper prices arise from a decrease in consumer demand. This can be a chicken or an egg situation. The decrease in demand can be the result of economically-challenged consumers, or consumers that are witnessing deflating prices and thus delaying purchases until they see even lower prices. Either way, this is bad.

A decrease in consumer demand leads to lower prices by producers. This leads to lower margins and lower profitability. This leads to lower economic output and lower employment. The lower output and employment leads to even less consumer demand. And on and on… You can see how it can be a vicious cycle and why central bankers around the globe are bent on avoiding that scenario.

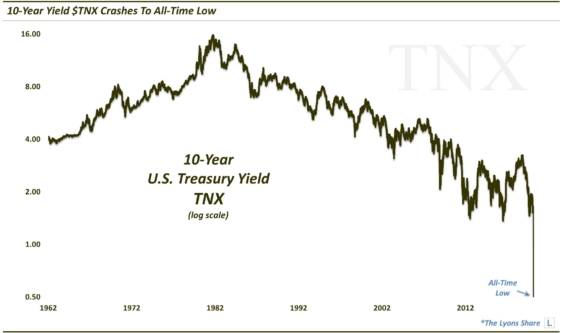

The problem now is that after extraordinary liquidity measures for years (so long that the measures are now ordinary), there has been no pickup in inflation whatsoever. In fact, it is going the other way. Economic growth has slowed globally and commodity prices are crashing. And with bond yields basically at zero, central bankers are in a deep hole here. All they can do is go full-on Zimbabwe or Weimar Republic it would appear at this point. The problem is that they are all competing with each other in the same endeavor.

We understand our brief foray into economics may appear to downplay economic and employment growth in the U.S. However, despite the headline numbers, we are not as sanguine as many economists and strategists are. While there are some pockets of strength, much of it appears to be a mirage. At least from a market and corporate perspective. All the balance sheet engineering, corporate financing and buyback exercises have served to merely inflate stock prices. If that cycle is plateauing or turning down, that would exacerbate the deflationary pressures.

We will attempt to avoid further economic discussion on these pages as it typically doesn’t directly lend itself to effective investment progress. However, the inflation-deflation debate does seem to be one with pertinent investment repercussions. Therefore, keep an eye on the 5-Year Breakeven Inflation Rate as it continues to drop toward dangerous deflationary territory.

______

“105:180 Earth, Deflated” photo by Justin Kilner.

Read more from Dana Lyons, JLFMI and My401kPro.