Dollar Rally Getting Stretched

When you think about the major financial market trends of the past 6-12 months – e.g., the oil and commodity rout, the plunges in foreign currencies, the out-performance of U.S. markets – most of them have an underlying dynamic in common: U.S. Dollar strength. In our 2014 Charts Of The Year post, we included a chart on the Dollar from back in February. It highlighted the Dollar’s extremely narrow range of the past 8 years, noting that “the range break should be a doozy”. Well, indeed it was a doozy as the Dollar has risen about 15% since then, with most of gain coming since June.

These breakouts from tight ranges tend to be both explosive and lasting. We have certainly had evidence of the explosiveness. How long the rally lasts remains to be seen. However, even if the Dollar is entering a new cyclical bull market, i.e., in “years”, there is evidence that it may be getting a bit stretched at this point.

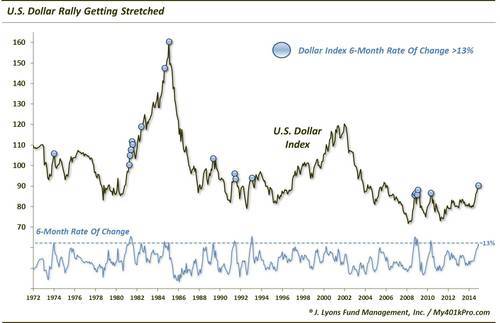

Through December, the U.S. Dollar Index (DXY) had rallied over 13% in the past 6 months. Looking historically, the DXY has consistently run into trouble after a 6-month rate of change that high.

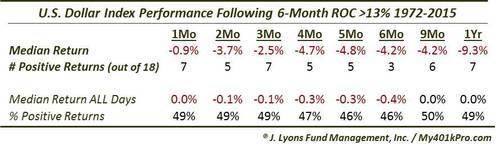

DXY rallies in 1974, 1989, 1991, 1993, 2008 and 2010 all either stalled or were outright ended soon after the 6-month rate of change hit the +13% level. Only during the Dollar super-bull in the early 1980’s when the currency nearly doubled did it continue higher after reaching that ROC. And even then, only 3 of the 7 times the DXY hit a 6-month ROC during that stretch was it higher 6 months later. Here is the Dollar’s performance after all 18 such months since 1972:

Though the DXY was able to buck the trend on occasion, median returns were much weaker than average across all time frames, from 1 month to 1 year. After 6 months, just the 3 times mentioned above saw positive returns. And over no time frame was the DXY able to rally even 50% of the time.

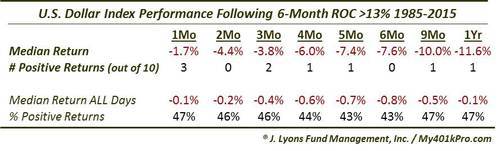

If the Dollar is initiating a new super-bull, the DXY may be able to power through this condition, although perhaps not without a hiccup along the way. However, if it is not starting a new bull market, its historical record suggests the rally may be on borrowed time. Consider these results in just the past 30 years since the super-bull:

We are primarily trend-followers. The trend in the U.S. Dollar is clearly up. Furthermore, after breaking out of a long-standing narrow range, moves can be long-lasting and substantial. Therefore, the Dollar has a lot going for it still. That said, even if the DXY is entering a new bull market, its 6-month rate of change suggests, from a historical basis, the currency may be in need of a breather. If it is not commencing a bull market, history suggests that the rally’s days, or at least months, may be numbered.

________

“Stretching the Dollar” photo by Lance Page.

More from Dana Lyons, JLFMI and My401kPro.