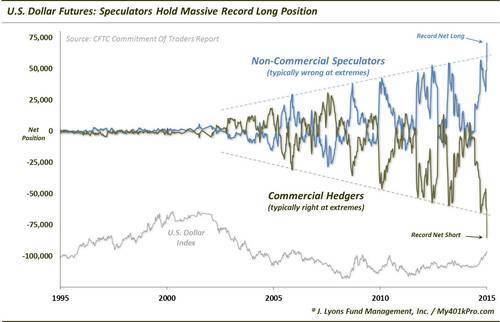

Speculators Hold Massive Record Long Position in the U.S. Dollar

We have referenced the Commitment Of Traders report published by the Commodity Futures Trading Commission on several occasions. The COT report provides a breakdown of long and short positions in the various futures contracts on the part of certain types of entities. Specifically, the CFTC breaks the entities down to “Commercial” and Non-Commercial" segments.

- In general, Commercials, or “Hedgers” are typically involved directly in an industry reliant upon a particular commodity. Most of the time, they are truly “hedged” against the commodity and, since they are most intimately familiar with the commodity, are considered the “smart money”, at least when the market hits an extreme

- Non-Commercials, or “Speculators” are by and large commodity pools and funds that exist mainly to trade the market long and short. These funds are normally trend-following entities and while they can be on the correct side of a long trend, at extremes they are considered “dumb money” as they are typically “off-sides”

Though we peruse the COT report each week, probably 95% of the time, there is nothing to be gleaned from the positioning in a particular futures contract. When positions do hit an extreme (based on historical context), however, we take notice. A case in point was our July 3 Chart Of The Day looking at positioning in Crude Oil futures. At the time, the contract was showing the largest spread between Speculators (long) and Hedgers (short) that we recall ever seeing in any futures market. We may have a solid runner-up to that example now via U.S. Dollar futures.

As the chart reveals, up until about a decade ago, the COT data on Dollar futures fluctuated within a fairly tight range. Since then, the range has grown along a consistently expanding path. As of last week, the COT positions sprung to the outer bound of the expanding range. The Commercial Hedgers set an all-time record net short position of over 85,000 contracts and the Non-Commercial Speculators reached an all-time record long position of nearly 70,000 contracts.

As we mentioned, when COT positions reach an extreme, we take notice. It doesn’t get more extreme than an all-time record. Of course, extremes can always get, well, more extreme. In that light, considering the ever-expanding COT range over the past 10 years, one possibility to consider is that the market has entered into a new paradigm wherein either previous levels that used to be considered extreme no longer are, or the entire concept of extremes is irrelevant. That is, perhaps the dynamic of smart vs. dumb money positions signaling inflection points in the market has ceased to exist.

We don’t feel that’s the case. We think COT position extremes, by and large, are still accurate reflections of sentiment extremes. By the definition of extreme, that means they cannot be sustained. Thus, markets will continue to succumb to the pressure to shift in trend once too many investors are on board in one direction.

One piece of evidence that suggests this is still the case is the fluctuation of the COT Dollar positions within the expanding range. The Speculator vs. Hedger positions have continued to fluctuate between the top and bottom of the range. For example, When Hedger net short positions have expanded toward the bottom of the expanding range (shown by the dark yellow dotted line), the Dollar has tended to top shortly afterward. That suggests that, while the extremes are different, they continue to be relevant.

Furthermore, if there was a market that suggested a structural change in the way in which COT data was tabulated and utilized, it would be the Crude Oil futures. When we posted the chart in July, the Hedger and Speculator COT positions had basically gone parabolic, in opposite directions. And while there was still some small fluctuation along the way, it was more of a straight path than what we see in the U.S. Dollar, which still has wide swings within the expanding range. Considering the record high in Speculator longs in Crude Oil in July and the subsequent crash in prices since, the COT data still appears to be relevant as a marker of sentiment extreme.

We suspect that the proliferation of commodity-based ETF’s has a lot to do with the expanding range in the open interest in COT positions. Many of the ETF’s use futures as their investment vehicle and their growing popularity means an increase in their corresponding futures contracts and an expansion of open interest.

However, that does not negate the COT data as a useful indicator of sentiment extremes. And considering the current record long position on the part of Speculators, who are typically on the wrong side at major turning points, the U.S. Dollar rally could be in danger at some point soon. This is especially true given what we looked at last week regarding the Dollar’s 6-Month rate of change. So while the U.S. Dollar remains in a strong uptrend at the moment, bulls should at least have money management strategies in place in case of a reversal in trend.

________

More from Dana Lyons, JLFMI and My401kPro.