Fewer Stocks Contributing To Nasdaq Highs

With all eyes focused on the Nasdaq approaching its 2000 highs, one aspect of its recent ascent may be overlooked. There are fewer and fewer stocks participating in the Nasdaq 100 (NDX) 52-week highs. Specifically, at a recent new high, just 66, or just less than two thirds of the NDX’s components were above their 50-day simple moving average.

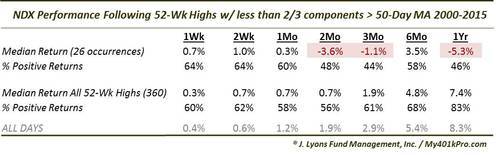

While 66 may not seem too bad, it is actually relatively quite low, historically speaking. Since 2000, the Nasdaq 100 has scored a 52-week high on a total of 360 days. Just 26 of them, or 7%, occurred with less than 67 of NDX components trading above their 50-day moving average. The average (and median) number of components above their 50-day moving average on a day that the NDX closed at a new high is 81.

From a simple glance at the chart, it is obvious that similar readings over the past 15 years occurred at very inauspicious times. These include March 2000, October 2007 and July 2011. Though, more recent occurrences in the past few years did not result in any substantial damage afterward. Overall, here are the results following all of the days in the past 15 years in which the Nasdaq 100 closed at a 52-week high while less than two thirds of its components were above their 50-day moving average.

After very near-term strength, the returns following such days was awful in the intermediate to long-term. These results are obviously greatly influenced by the number of events occurring in 2000 and 2007. However even 4 of the events occurring during “good” markets in 2003, 2009 and 2014 showed negative returns 3 months later. So even if this condition does not lead to disaster, it may still lead to subdued NDX performance in the intermediate-term.

What are the potential flaws in this interpretation? Well, for one, this weakening condition can A) repair itself or B) persist for awhile. Regarding A, the NDX has indeed shown improvement the past 2 days with the number of stocks above the 50-day moving average now at 70. However, in many of the examples in the chart, the number went on to improve some as well before the index rolled over. So the very recent improvement does not necessarily negate the negative ramifications.

Regarding B, the deterioration certainly can last for some time before any negative effects arise. This is the case with any divergence, as we have emphasized many times over the past year. One potentially deteriorating impact of that defense, however, is that this weakening (along with many other divergences) has already been persisting for some time now. A case in point: this phenomenon has been sporadically occurring for 16 months now. So while divergences can persist for awhile, they cannot persist forever. The event that we call the “great divergence” from 1998 to 2000 eventually flamed out (spectacularly) after nearly 24 months.

Speaking of that late-1990’s period, some may be wondering why we did not include it. The only reason is because we do not have the data before 2000 (h/t to Jason Goepfert at SentimenTrader.com for the data, btw). It is entirely possible that this signal triggered during the late-1990’s also, well before the early 2000 occurrences. While dates from that period would improve the performance figures in this study, the fact remains that we are now 16 months into a string of these readings without any damage done. Again, while it does not mean the NDX is necessarily contending with impending doom, the divergence of sorts has already persisted for some time.

By the way, this also does not mean we are overly negative on the index. We cannot be too bearish with it scoring 52-week highs. It just means that the quality of the highs is not what we’d like to see from a participation standpoint. We think it is entirely possible that some form of blowoff top materializes. Indeed, such blowoffs occurred to some degree after readings in 2000, 2007 and 2010. It does suggest, however, that whatever gains come about as a result of such a blowoff may very well be subsequently given back.

The impetus for this post came from a scan of each of the Nasdaq 100 constituent charts. Browsing through the list, we were frankly surprised at the number of either weak or stagnant charts we saw. It was apparent that the recent new highs in the index were a result of a relatively small number of stocks. The main contributors to the NDX’s 52-week highs recently include stocks from the retail, biotech and semiconductor sectors, as well as a certain company named after a fruit (no, not BlackBerry). Should any of these groups fall by the wayside, the index may very well be vulnerable.

The historical precedents of the weakening condition in this study suggest that if that occurs, whatever gains accrue in the short-term may not last in the longer-term.

________

More from Dana Lyons, JLFMI and My401kPro.