Gas Prices Far Outpacing Crude: Blowoff Top or Long-Term Bottom?

If you’re like us, maybe you wonder why gas prices always seem to go up a lot faster than they come down. That’s our anecdotal observation anyway. We’ve never actually tested it…until now. It turns out, based on the past 7 years anyway,there may be some truth to that observation.

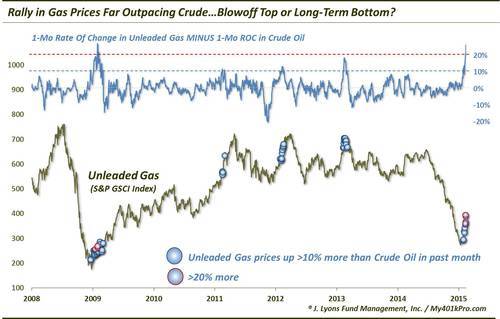

The impetus for this post is the recent jump in gas prices. While it’s no secret that crude oil has had a huge rally off its lows of about a month ago, the rally in gas prices has far outpaced it, by 25%. Over the past month, the price of crude oil is up roughly 15%. Meanwhile unleaded gas has risen nearly 40%! Over the past 7 years, the only other time gas prices have outpaced crude by that much in one month was coming off of the post-crash lows in early2009. Now before getting too worked up about gas prices being off to the races again, consider that the other 3 times during this period that gas prices rose at least 10% more than crude oil over a 1-month span, gas was actually approaching a top.

As the chart points out clearly, the 2009 instance in which gas prices shot up much faster than crude oil ended up being a long-term low in the price of unleaded gas. Two years later, gas prices had climbed nearly 200%. This type of move is indicative of a momentum thrust off of a very oversold condition. Such a thrust in prices off the low can at times lead to a longer-term sustained advance, as it did in the 2009 instance. We cannot dismiss the possibility that the current move higher in gas prices is of a similar nature, particularly considering the similar “crash-like” behavior preceding it.

However, we also cannot dismiss the message of the other 3 precedents of relative 1-month outperformance by unleaded gas over crude oil. Though the “thrusts” in the gas versus oil rate of change did not meet that of 2009 or today’s, jumps in 2011, 2012 and 2013 led to intermediate-term tops rather than extended bull markets. While in 2011 and 2012, gas prices continued to rally in the short-term, by 6-months later, the 3 occurrences all saw prices much lower.

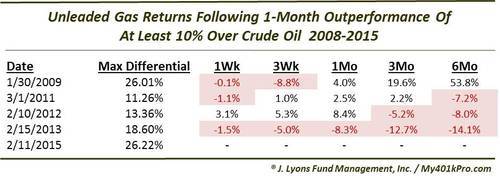

Here is the performance of unleaded gas prices following all 4 prior unique precedents in which gas outpaced crude oil by at least 10% over a 1-month span. The returns are measured from the date of the most extreme disparity between gas and oil prices. This, of course, is only known in hindsight. However, these extremes in the gas:oil spread do not typically last for more than a few weeks.

As the table points out, the 2009 event was followed by weakness in the very short-term and a huge rally over the long-term. The other events went somewhat in the opposite direction. The 2011 and 2012 incidents at least showed continued strength in gas prices over the next month. However, by 6 months out, both those 2 occurrences and the 2013 occurrence resulted in depressed prices 6 months later.

So which path will our current scenario follow? As we stated, there are some obvious parallels between 2009 and our current circumstances. In terms of shorter-term cycles, we are certainly nearer to the 2009 situation than the others considering the fact that we are coming just off of crash-type lows. The other occurrences followed at least intermediate-term advances in unleaded gas.

However, we hesitate to put too much stock into one single precedent. Furthermore, despite near-term similarities, the close proximity, time-wise, to 2009 makes it extremely unlikely that we are at a similar juncture in the larger secular cycle. Furthermore, the macro environment that exists today has significant differences than that of 2009, as a unique period always will.

It is surely oversimplifying things, but perhaps the short-term behavior in gas prices may give us a head’s up on its longer-term prospects. Should we see weakness in the near-term (like in 2009), maybe a longer-term low is in and gas prices will continue to rally in the long-term. Conversely, if we see a continued rally in the near-term, ala 2011 and 2012, perhaps it will fade over the longer-term like the last 3 incidents. Again, that’s just over-simplified speculation. It remains to be seen what transpires.

Getting back to the original topic, is tere any evidence that gas prices rise faster than crude oil prices? Well, looking at the past 7 years, the 1-month rate of change of unleaded gas has been greater than that of crude oil on just 48% of all days. Thus, crude oil has had a higher rate of change on 52% of all days. However, measuring the extreme changes, we find that there have been 75 days in which the 1-month rate of change in gas prices was at least 10% greater than crude versus only 60 days when gas prices were more than 10% lower than crude oil over the preceding month. And there have now been 8 days in that time span that gas had outperformed by at least 20% over 1 month versus just 1 day of 20% underperformance by gas.

So the evidence is thin but one can make the case that, in times of extreme moves in fuel prices, gas prices do generally tend to go up faster than crude prices. We suppose that, at a minimum, that’s enough to maintain one’s ire toward the “evil” gas companies.

________

Gas station photo by Ha! Designs – Artbyheather.

More from Dana Lyons, JLFMI and My401kPro.