10-Year Yield Entering Technical Battle Zone

The last time we mentioned the 10-Year Yield (TNX) entering key resistance was November 5 (Bond Bulls Need To Step Up Now). We suggested the area the TNX was hitting was a key spot for bond bulls to defend if they wanted to prevent a more substantial rise in rates. And defend they did as the TNX dropped roughly 70 basis points over the next 3 months. It is time for them to step up again.

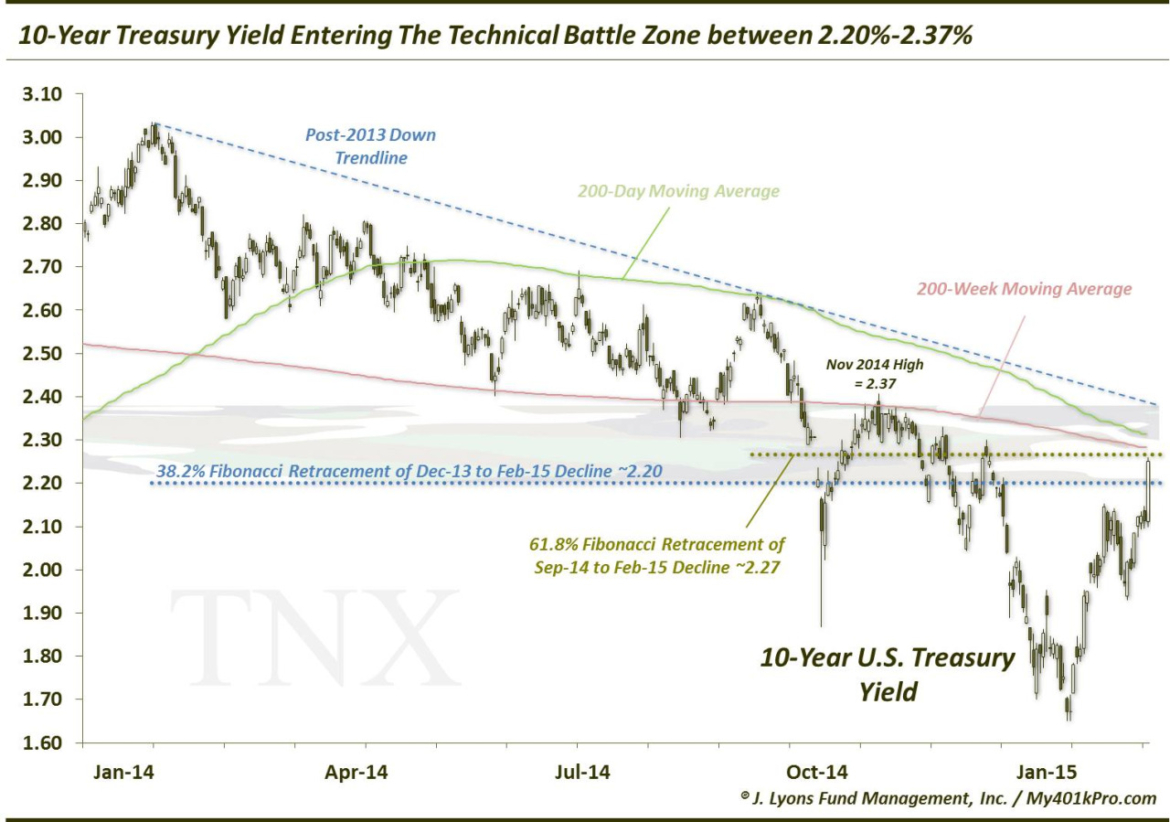

Thanks (presumably) to the better than expected jobs news on Friday, bonds tumbled and rates jumped. The 10-Year Yield, in our view, entered a key technical zone between 2.20% and 2.37%, that could decide whether this is merely another counter-trend rally in yields, or a possible change in trend. Consider the significant levels within this zone:

- 38.2% Fibonacci Retracement of the December 2013 to February 2015 decline ~2.20%

- 61.8% Fibonacci Retracement of the September 2014 to February 2015 decline ~2.27%

- 200-day moving average ~2.30%

- 200-week moving average ~2.28%

- November High ~2.37%

- Post-December 2013 down trendline ~2.35%

While economists have long been calling for rates to rise, bond bulls have had the upper hand over both the intermediate-term since 2013, and the long-term since 1981. The battle within this critical technical zone may not resolve the issue of the fate of the post-1981 bull market. However, it should determine who has the advantage in the intermediate-term between the bond bulls and bears. And if the bears are successful, it would arguably establish a higher low on the longer-term chart of the 10-Year Treasury Yield (though, not in the 30-Year).

Either way, it should be quite a battle.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.