Signs of Froth in the Biotech Sector

There is a fervent debate in some financial circles regarding the existence – or non-existence – of a biotech bubble. It is a challenging, and perhaps pointless, debate given the subjectivity surrounding the word “bubble”. It brings to mind the famous quote by United States Supreme Court Justice Potter Stewart when attempting to define pornography: “perhaps I could never succeed in intelligibly [defining pornograph]. But I know it when I see it.” So it is with bubbles. They are especially easy to see after the fact. But in the midst of a bubble, the hysteria surrounding its inflation of prices is so intense that it is easy for folks to get caught up in it. That’s what allows the bubble to develop.

So where do we fall in the biotech bubble debate? We would side with the “yes, it is a bubble” camp. Understand that we do not use that term loosely either. In our view, bubble claims are thrown around far too often. Not every sharp increase in asset prices is a bubble. Most are simply part of the cyclical pattern of ups and downs that takes place in any market-based pricing structure. True bubbles are a product of human nature manifested in manic behavior and parabolic price increases.

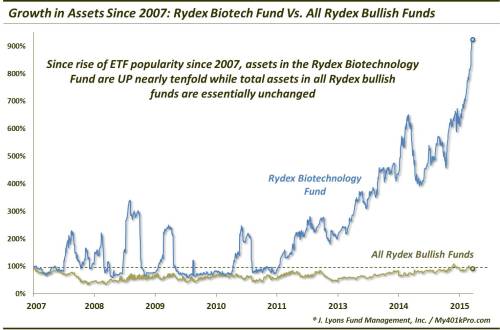

One possible example of this mania is evident in our Chart Of The Day. We have discussed the topic of assets in Rydex Mutual Funds on several occasions. As Rydex Funds are geared toward active traders (or at least non-buy & hold investors), the level of assets in their funds, either as a whole or in an individual fund, can be useful as a gauge of sentiment. Although, with the rising popularity of ETF’s, the Rydex Funds have generally seen a slump in their assets, especially relative to ETF’s. As this chart shows, however, that has NOT been the case with the Rydex Biotechnology Fund.

As we mentioned, ETF’s have taken substantial market share from active mutual funds since their emergence on the scene. Most Rydex funds have a fraction of the assets they had around the turn of the century. Since the popularity of ETF’s really started to accelerate around 2007, we began this chart with the end of that year. Since that time, the total assets in Rydex’ “bullish”-oriented index funds (shown by the beige line) is essentially flat. Although, during almost that entire period, total bull assets were well below 2007 levels. Just recently, after the S&P 500 had risen roughly 35% above its 2007 highs, assets have finally reached their 2007 levels again.

The Biotech Fund, however, is a different story. Since 2007, assets in the fund have increased from around $58 million to $567 million as of Friday, a nearly ten-fold increase in assets. And in fact, the entire sustained gain has come just since late 2011 when the biotech run really began to accelerate. We wanted to compare it with the total assets, however, which are merely unchanged since 2007. This suggests that it is not simply a case of market appreciation contributing to the rise in assets, otherwise we would be seeing a rise in Rydex bullish assets across the board.

More likely, it is a function of sentiment or perhaps developing manic (or bubbly) behavior taking place. While much of the assets have fled active mutual funds for ETF’s, it is not the case with the Biotech Fund. Despite the popularity of biotech ETF’s like IBB and XBI, traders have become increasingly comfortable leaving their assets in the Rydex Biotech fund. And this comfort level has apparently grown significantly – almost parabolically – in recent months. As recently as October, Rydex Biotech Fund assets were half the level they are now. So after increasing five-fold in about 3 years, they have done so again in just the past 6 months. This is frothy behavior.

That said, the truly difficult (impossible?) task is to determine when a bubble is going to pop. Indeed, even a few weeks or days early or late can result in substantial cost, either realized or opportunity. And this is where we can understand the point of engaging in the bubble debate. We acknowledge the allure of traders in embracing the rise in biotech equity prices, and have participated ourselves. We also understand the aversion on the part of long-term investors in climbing on the bandwagon, given the steep price increases.

We would just urge folks who are jumping on, or thinking of jumping on, the biotech bandwagon to consider some sort of risk-managed approach in case the bubble, or whatever one wants to call it, ends up popping. As we said, the difficult thing is knowing when a bubble will indeed pop. And the potential gains available before that occurs could be substantial. We have no idea, but it certainly would not shock us to see the sector rise another 30% before it implodes.

However, investor behavior suggests that there is indeed bubbly action going on in the biotech sector. In Judge Stewart’s words, we know we see it. We just don’t know when it will pop.

__________

“Fun with dry ice!” photo by Dan Tentler.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.