Volatility Has Not Expanded With Recent Euro Plunge

We wrote a post last week called “Setup In Place For Possible Euro Bottom”. Given this week’s epic continued collapse in the currency, it probably looks pretty silly. As the title states, however, our point was that the “setup” was there for a bottom. It does not guarantee the setup will be triggered. Indeed, we made a point to emphasize the following:

“The potential Euro bottom is triggered ONLY IF PRICE REVERSES BACK ABOVE 1.12.”

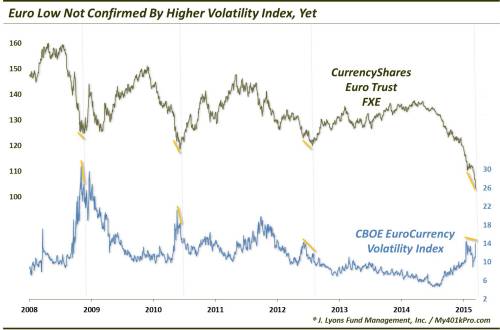

Needless to say that reversal has not occurred. Instead, the Euro is down over 3 full cents this week – and still dropping. One interesting development (or non-development), however, has been the the action in the currency’s volatility index. Typically, when the price of (most) assets drop, their expected volatility, as expressed by a volatility index, rises. This has generally been the case with the Euro as well. Interestingly, however, despite the drop in the currency to new lows this past week, its volatility index has not made a higher high above its January peak. This condition, non-confirmation if you will, has been seen at some other interesting junctures in the currency over the past 7 years.

The chart shows specifically the CurrencyShares Euro Trust exchange traded product (ticker: FXE) on top and the CBOE Volatility Index on the FXE (EVZ) on the bottom. As shown, the EVZ topped out during January’s Euro decline at 14.55 on a closing basis (nearly 17 on an intraday basis). During the FXE’s current decline to new lows, the highest close it has achieved was on Wednesday, at 14.09.

While the EVZ does not have to go to a new high for the Euro decline to continue, as the chart points out, these non-confirmations have occurred at previous lows since 2008. Each of the significant lows in the FXE in 2008, 2010 and 2012 saw the EVZ make at least a slightly lower high at the FXE’s low-point. Again, this kind of divergence does not have to occur at a major low. We just think it is interesting that A) it has occurred at prior lows and B) it is occurring now, despite a substantial new low in the Euro.

Now perhaps the Euro continues to collapse towards par (which we mentioned in last week’s post is the next area of potential support that we see, based upon technical reasons). And perhaps the Euro volatility index eventually makes a new high. Who knows, maybe it gets there today? (indeed, I am feverishly typing to get this posted before this occurs). That would obviously make this post moot. But until that occurs, we find this non-confirmation interesting.

Lastly, no, we are definitely not merely looking for evidence to back up our post from last week. We go wherever the data leads us and that’s what we are doing now. Besides, we laid out our Euro-bull reversal case clearly. Absent a reversal above 1.12, we would stand aside.

This will be a development we’ll continue to monitor, especially if the Euro approaches par over the coming weeks – or days – or hours.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.