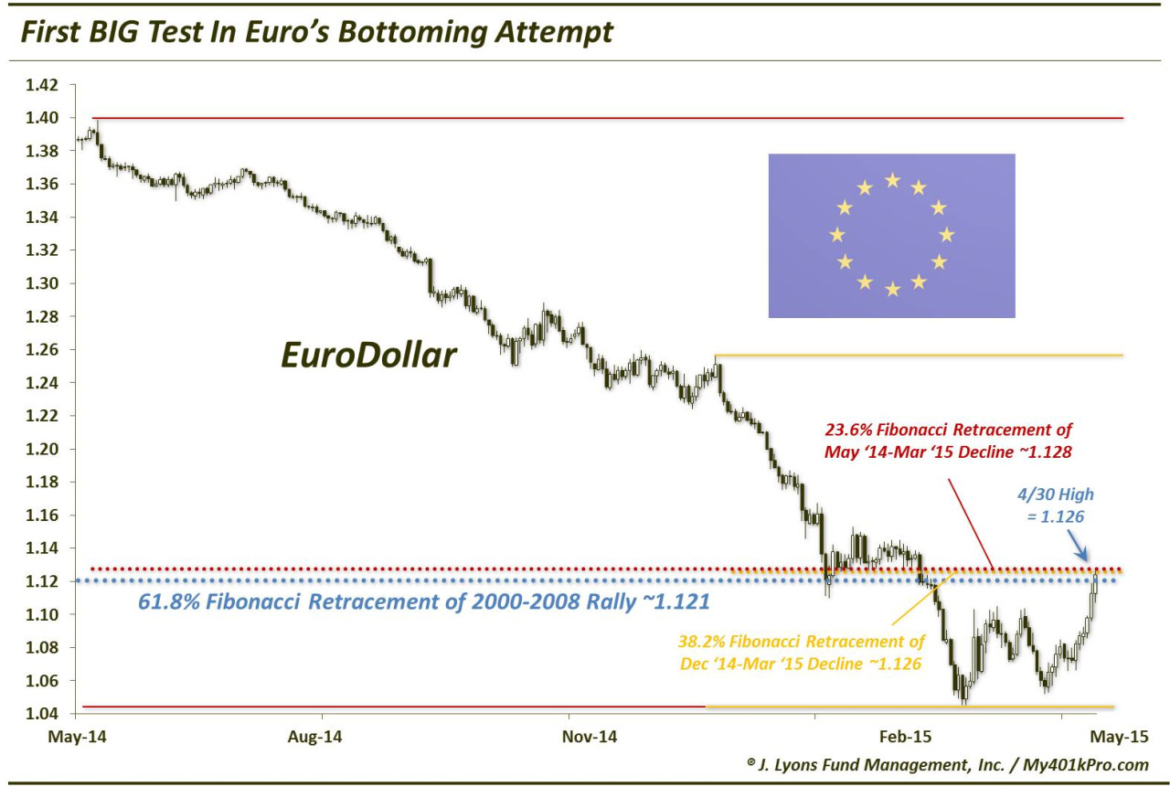

UPDATE: Euro Facing First BIG Test In Its Bottoming Attempt

On March 4 we posted a piece titled “Setup In Place For Possible Euro Bottom”. In that post, we laid out a possible scenario wherein the Euro could finally attempt to establish a bottom of some significance following its bloodletting since last May. The key point was a technical one. On an initial low on January 23, the Euro closed at 1.12. The significance of that level is that it represented the 61.8% Fibonacci Retracement of the Euro’s move from its all-time low in 2000 to its all-time high in 2008. In our experience, it does not get much more significant than that.

At the time of the March 4 post, the Euro was breaking down below that low. The point of our post was that, given A) the huge significance of the 1.12 level, B) the utterly washed-out status of the currency and C) the record short position on the part of speculators in Euro futures, the setup was in place for a potential bottom. Breaking the 1.12 level was obviously a concern. However, it was not a surprise since we figured that in order to establish the strongest potential bottom, the level was likely to break, temporarily, before being recovered. Thus, we have been on the lookout for such a recovery.

Admittedly the breakdown went a bit deeper and the current bounce has taken a bit longer than is optimal for a false breakdown. However, given the importance of this asset globally and the violence of the preceding decline, any magnitude of extremity should not be a surprise. Thus, we believe the setup we laid out is still valid – and potentially in the works now. As we said in the March 4 post, traders should watch for – but not anticipate – the recovery of the 1.12 line before considering the potential bottom to be developed.

Given the depths of the breakdown below 1.12, we have a slightly tweaked level to monitor regarding the Euro’s recovery. It is still in the same 1.12 ballpark, however, the lower lows gave us a new reference point to use in further determining the precise significant levels. Specifically, using Fibonacci Retracements from various highs over the past year down to the recent low, we can derive these levels which the Euro will need to recover before it is likely to accelerate any move to the upside. Specifically, those levels are the following:

- The 61.8% Fibonacci Retracement of the 2000-2008 Rally ~1.121 (still)

- The 38.2% Fibonacci Retracement of the December 2014-March 2015 Decline ~1.126

- The 23.6% Fibonacci Retracement of the May 2014-March 2015 Decline ~1.128

- Additionally, the consolidation following the initial January 23 low ~1.12 – 1.13

Last week, we posted a chart of the U.S. Dollar, noting the first demonstrable cracks in the armor of its rally. We suggested that this was perhaps the most noteworthy development of the week, despite many equity markets achieving milestones. Indeed, its weakness has spilled over to this week, evidently sending some shockwaves throughout the global financial markets. This includes the Euro currency, naturally, as it is the major counter-weight to the Dollar Index. This week’s major development could possibly be the move in the Euro.

The Euro has traversed the potential bottoming course that we laid out in March, though in a more deliberate fashion. Nonetheless, the moment of truth is here for the currency. The 1.12-1.13 area is THE big challenge that the Euro must overcome if we are to consider a potential long-term turn higher. Given the significance of the level, we do not expect it to give way easily – just as the Dollar rally will not easily die. The Euro is presently challenging this key area, reaching as high as 1.126 today. While the first attempt at this level is likely to fail, we will continue to watch it. If and when the Euro is successful in overcoming the 1.12-1.13 level, in our view, a major longer-term turn higher could be in the works. And given the record shorts in the Euro still, a move above that level could see a rapid acceleration of the bounce, fueled by massive short-covering.

________

from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.