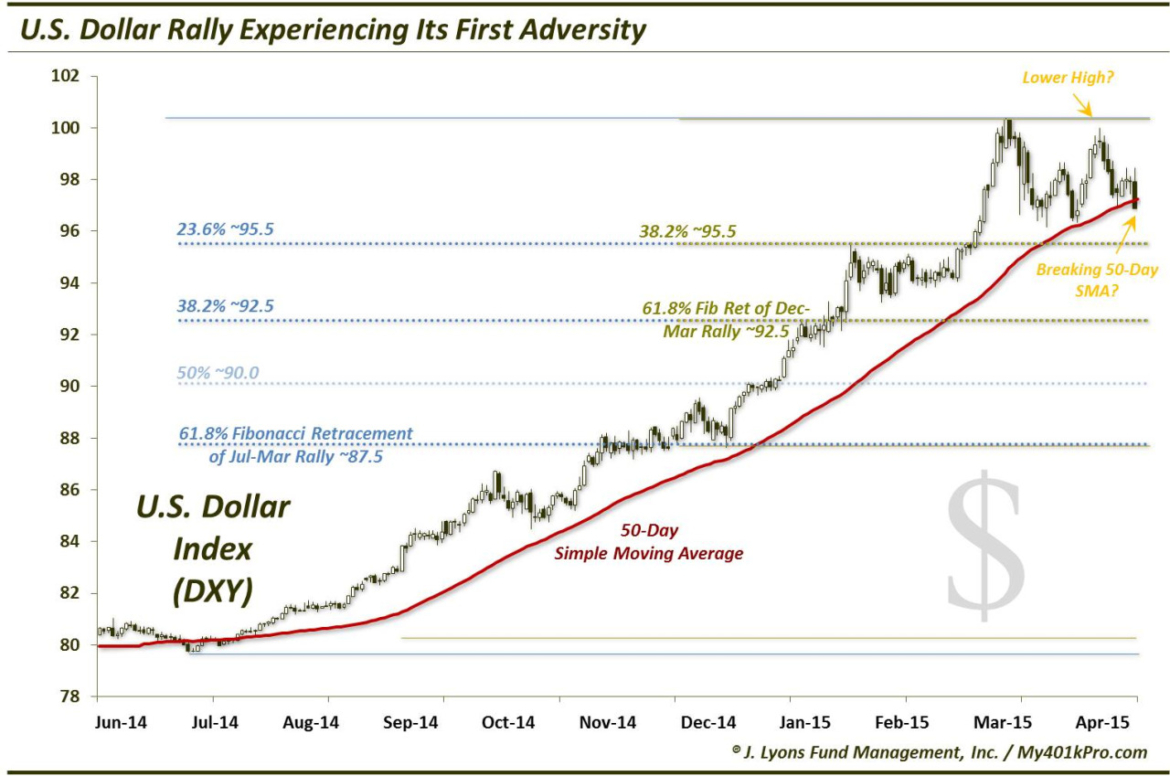

U.S. Dollar Rally Experiencing Its First Adversity

Despite all the milestones and records taking place this week in the equity market, at home and abroad, the most significant event of the week may be the action of the U.S. Dollar. The Dollar, as represented by the Dollar Index (DXY) has been on a tear, rallying some 25% from last July to March. This is a huge move for the global reserve currency. Perhaps the most impressive aspect of the rally has been its persistence. It has hardly had a hiccup along the way – until now.

Today, the DXY is threatening to break below a few levels that may usher in significant headwinds for the currency, at least in the short-term.

- The DXY has fallen below its 50-day moving average for the first time since its rally kicked off last July.

- The DXY is threatening the early April lows. Should it drop below there, it would confirm the April 13 close as a lower high (below the March high), and thus constitute a downtrend.

- Should these breaks be confirmed, possible areas of support below on the DXY lie at 95.5, 92.5 and 87.5.

Given the global importance of the Dollar as not only an asset but as a pricing mechanism, the significance of this break should not be underestimated. A pullback in the Dollar would likely have major consequences globally across all asset classes. Foreign currencies (obviously), emerging markets and commodities may be the main beneficiaries and international developed equity markets perhaps would suffer the most. We may have already been seeing signs of this over the past few weeks as emerging market equities have picked up, along with select commodities, and the European equity rally has slowed.

We will emphasize that should the breakdown occur, it is merely a short-term development until evidence proves otherwise. The rally since July has been so momentous that a complete and sudden derailment would be highly unlikely. It would take a lot for this longer-term uptrend to be defeated. Thus, the developments of this week should merely be of a short-term nature. However, given the smooth ride thus far in the Dollar’s rally, this bit of adversity is noteworthy.

___________________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.