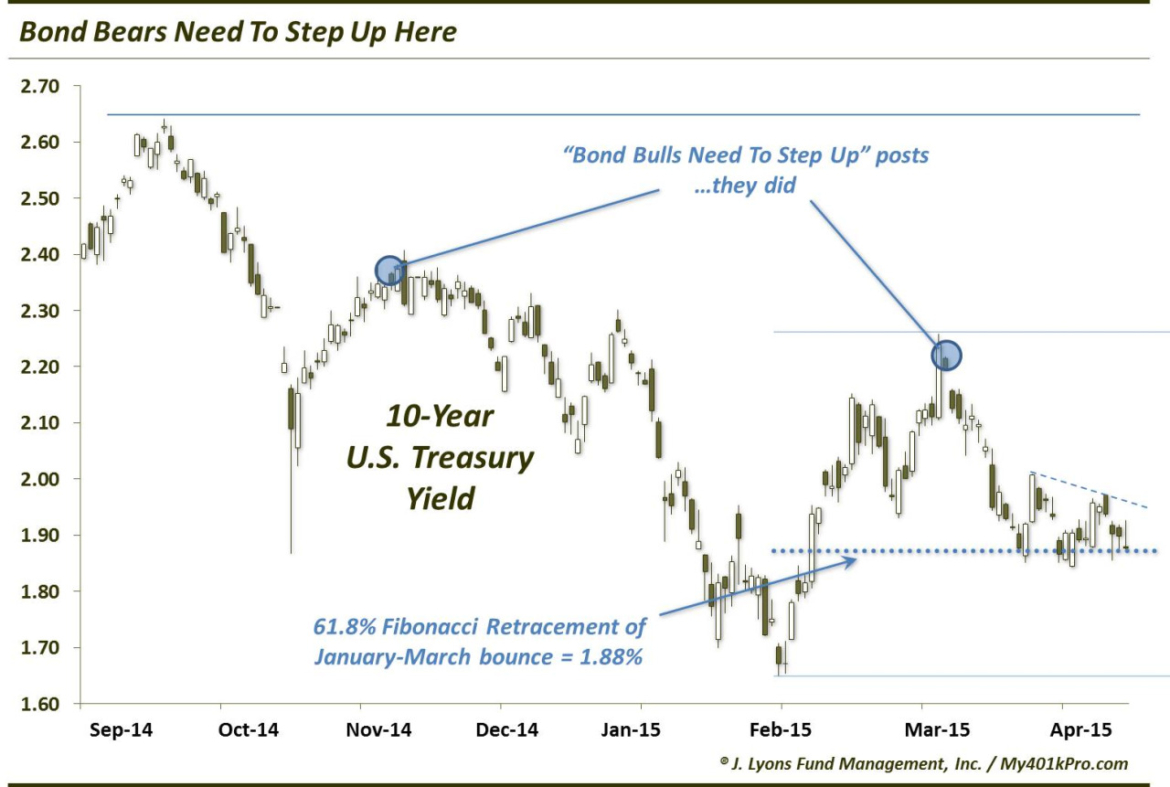

Bond Bears Need To Step Up Here

On November 5 of last year and March 9 of this year, we posted charts of the U.S. 10-Year Treasury Yield (TNX) with the message that “Bond Bulls Need To Step Up Here”. In these posts, we highlighted the fact that, according to our analysis, the TNX was running into important levels of resistance that, if broken, could lead to a significant rise in yields. Bond bulls indeed responded immediately each time, driving down yields and keeping the intermediate-term bond rally intact. Now it is the Bond bears that need to step up at current levels.

After breaking down to near 2-year lows around 1.65% in January of this year, the 10-Year Yield jumped up to 2.25% at the beginning of March. It has since leaked back down to around 1.88%. This level is significant in that it represents the 61.8% Fibonacci Retracement of the January to March bounce. Thus, in our view, it is critical for bond bears that it hold this level. The importance of this level has already be demonstrated as the TNX has held precisely there at least a half a dozen times over the past month. At the same time, Yields have made lower highs. This descending triangle pattern (more noticeable on an intraday chart) culminates to the downside more times than not.

If the 10-Year Yield breaks this key level around 1.88%, there appears to be very little to prevent it from testing the January 1.65% low again. As always, a break of this important level does not guarantee a free run at the lows. But it certainly would make the downside the path of least resistance. If Bond bears want to attempt to drive rates up, it would behoove them to start their effort now before this support level breaks.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.