ETF Spotlight: iShares Japan (EWJ) Testing Major Breakout Level

Much attention has been paid to the stellar performance of the Japanese equity market this year (though, perhaps not enough as the move in Chinese stocks has somewhat stolen their thunder.) The benchmark Nikkei 225 Index is up roughly 9% year-to-date, even after selling off sharply the past few days. The largest Japanese ETF in the world, the iShares MSCI Japan ETF (EWJ), is up about 11% on the year. This post looks at a potentially key development at a nearby level in the EWJ, as well as the origin of the level’s importance.

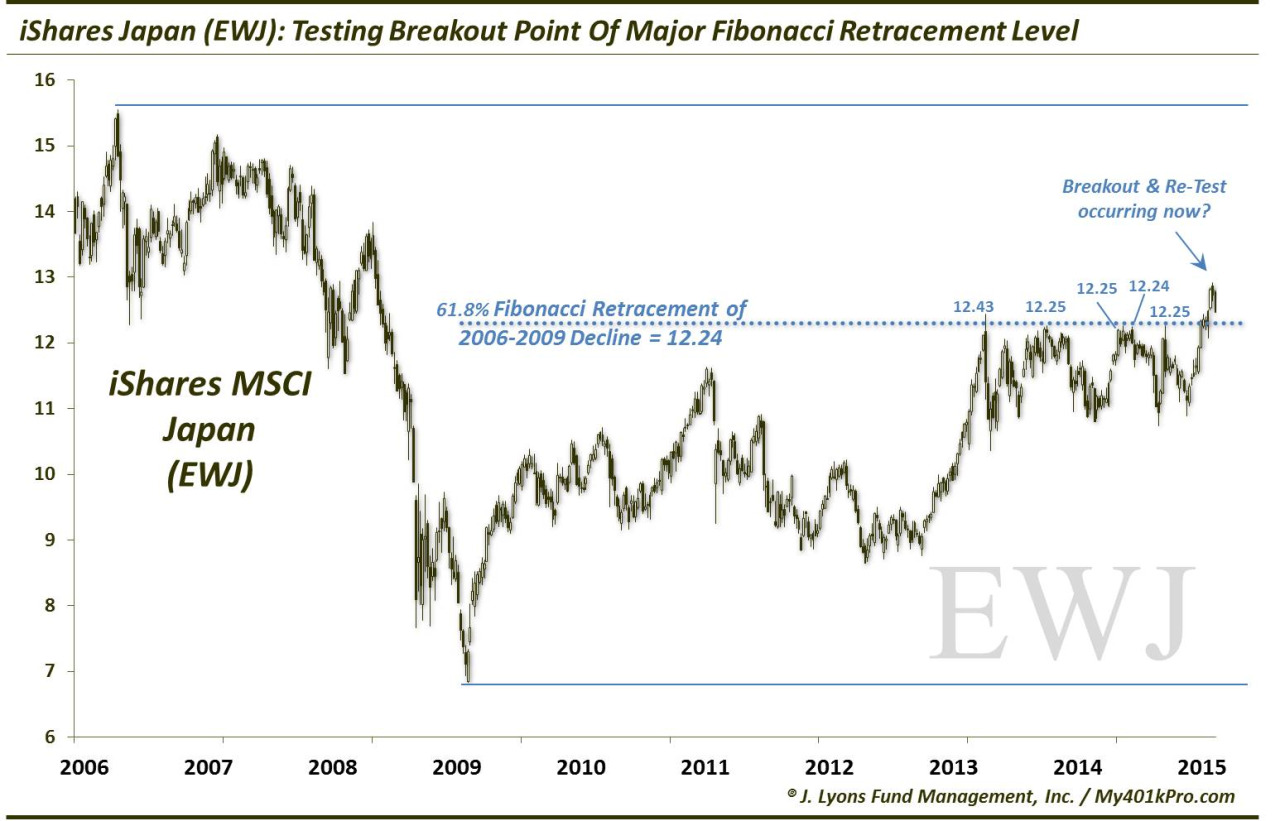

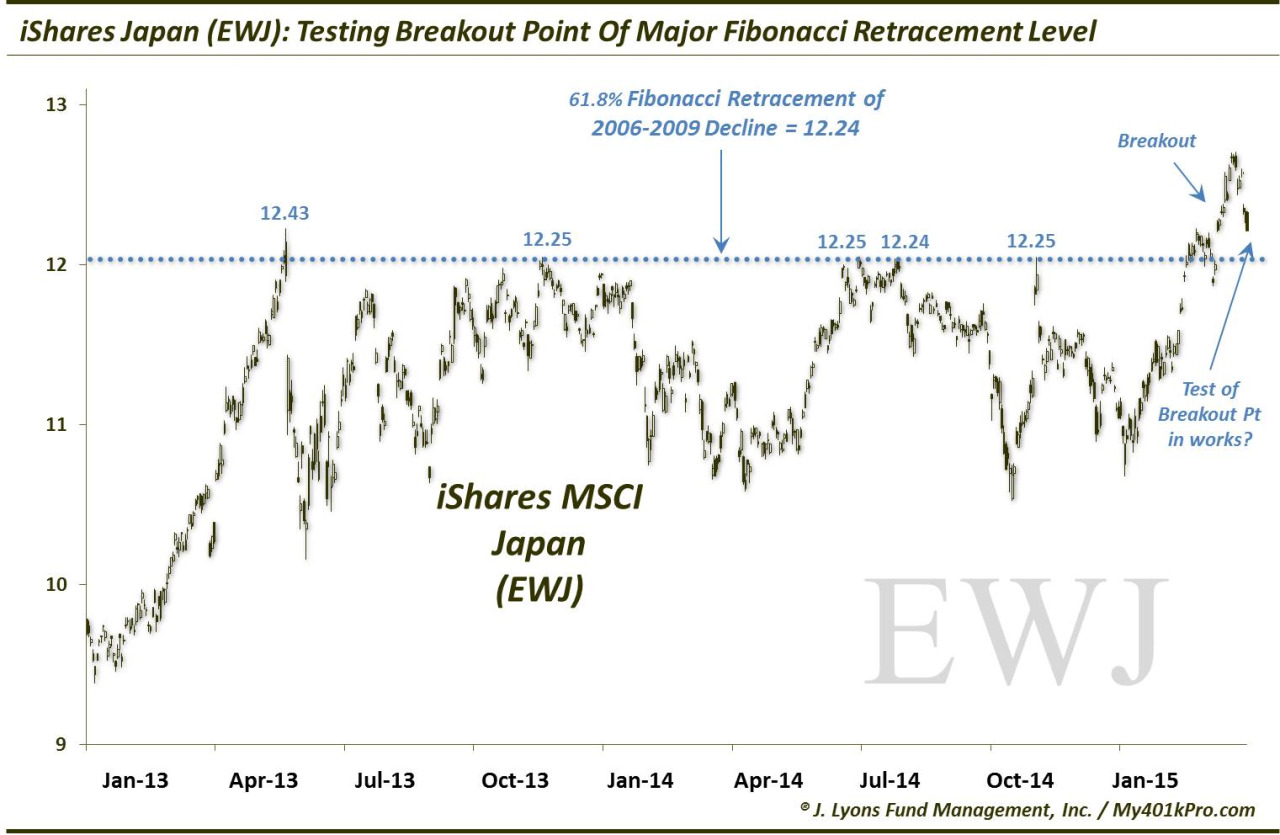

First, what is the key level? As shown in the first (long-term) chart, the high in the EWJ over the last 14 years occurred in 2006 around $15.5. A subsequent selloff led the EWJ all the way down below $7 in 2009. You have seen us talk about Fibonacci levels many times. Again, the most important Fibonacci Retracement level is 61.8%. The 61.8% retracement of the 2006-2009 decline lies at 12.24.

This level indeed has proven to be of major importance. The blast higher in early 2013 brought the EWJ to just above that 12.24 level temporarily (for 2 days), peaking at 12.46. Since that time, the ETF has been unable to surpass the 12.24 level, though not for a lack of trying. From June 2013 until last month, the EWJ traded up near that level on no less than 9 days, failing each time between 12.23 and 12.25 (this is best seen in the short-term chart above). That is what we call “respecting” a level.

EWJ was finally able to break above that level a month ago, traveling as high as 12.91. Currently, it is pulling back some, trading as low as 12.46 today. If this is part of a test of the breakout area, it could offer traders an attractive entry point near that 12.24 level, with a stop possibly triggered on a close below there.

This post, however, is as much about the effectiveness of Fibonacci levels in charting as it is this setup. It is now 6 years after the EWJ’s decline that produced the 61.8% retracement level. It simply strains credulity that 9 touches within 1 penny of that level over the past 20 months would be completely random. And the fact that EWJ respected the level that closely just increases the confidence in the importance of the level and the significance of the current potential setup.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.