Rates ARE In Fact Rising

For the better part of the last few years (decades?), if there was one thing that market strategists were sure of it was that interest rates were going to rise. And if there is one thing they have been consistently wrong about, it is their forecast for higher rates. The trend downward has been an especially one-way ride over the past 15 months. Each time rates threatened to move up, bond bulls stepped up right where they needed to and pushed rates back down (see November and March posts).

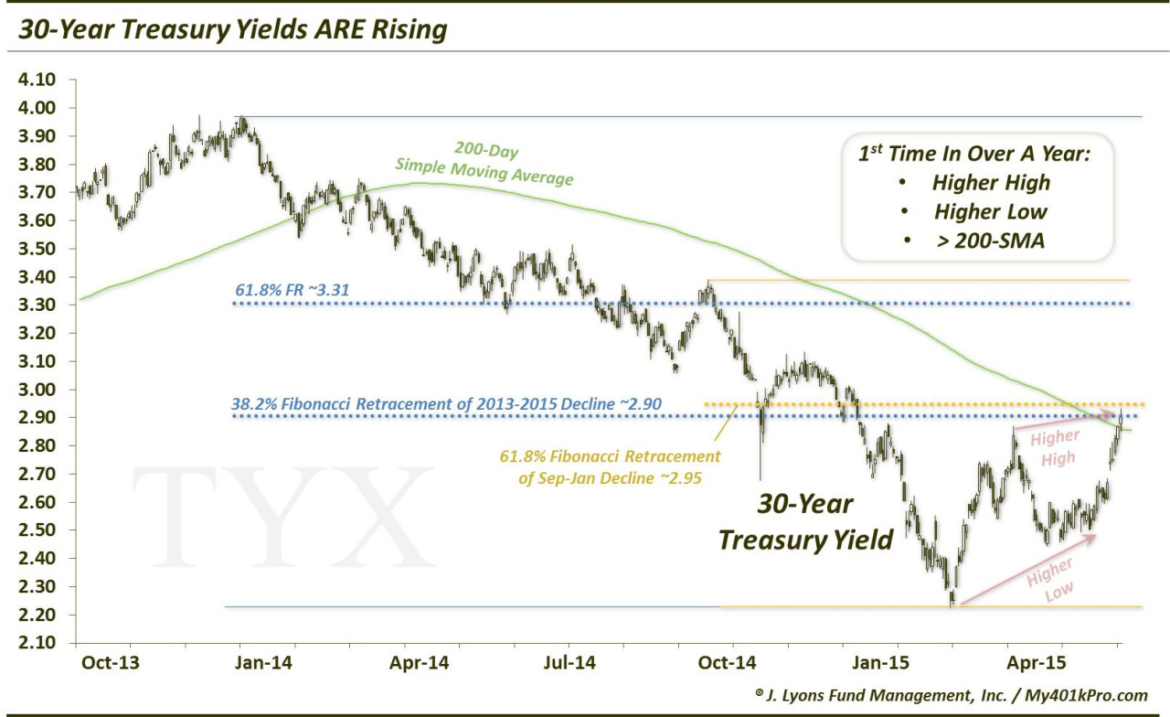

A few weeks ago, we posted that, due to the technical position of interest rates, it was the bond bears who needed to step up if they wanted to prevent another run at new lows. The bears did indeed step up and rates have been on the rise since. And in fact, as of yesterday, 30-year Treasury yields have exhibited preliminary signs of a potential change in trend, i.e., rates potentially are on the rise now.

At least, 30-year yields have achieved a few milestones necessary for a trend change that they had been unable to achieve for over a year. Specifically, the 30-year yield has:

- formed a higher high for the first time since 2013

- formed a higher low for the first time since 2013

- risen above the 200-day simple moving average for the first time since March 2014

Despite these milestones, a longer-term change in trend is not a guarantee. Presently, the 30-year yield is bumping against key Fibonacci Retracement levels from the December 2013 highs and September 2014 highs around 2.90-2.95. Should this level be overcome, the November highs around 3.10 (also representing a 50% retracement from the 2013 highs) would be the next target before a bigger test around 3.30-3.40. That level marks the September 2014 highs and the key 61.8% Fibonacci Retracement of the December 2013 to January 2015 decline. Surpassing that level would open the way for a potential longer-term turn higher in interest rates.

For now, at least when pundits proclaim their “higher interest rate” predictions, they have some evidence to actually point to – in the short-term anyway.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.