Traders Back Up The Truck To Buy Dip In Tech

One of the sources of fund flows we like to track on a daily basis comes from the tradable mutual funds offered by Rydex (now Guggenheim). While mutual fund flows and assets are down substantially since the rise of Exchange Traded Funds, this data can still provide useful information as it pertains to investor sentiment. And like most of the analysis into fund flow data, we look for extreme readings – and fade them, i.e., take the opposite position. The reason is that when a certain market, sector, fund, etc. has been the beneficiary of out-sized money flows, it often means the trade is becoming too crowded and likely has just about run its course.

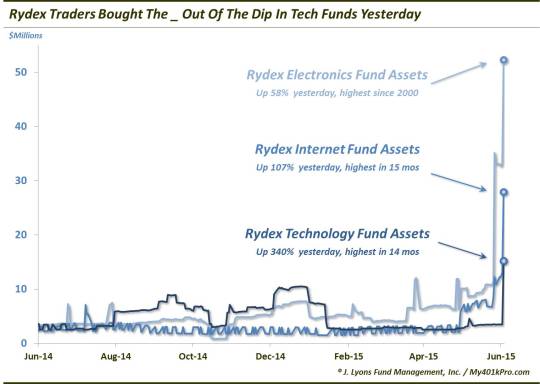

We saw one such possible example of this in the Rydex fund flow data yesterday. Specifically, although the market was down quite a bit yesterday, money actually flowed into funds in the technology sector – and a lot of it. This is unusual, especially considering the magnitude of the inflows. Consider the following:

- Assets in the Rydex Electronics (i.e., semiconductors) Fund rose 58% from $33 million to $52 million, the highest level since 2000.

- Assets in the Rydex Internet Fund rose 107% from $13 million to $28 million, the highest level in 15 months.

- Assets in the Rydex Technology Fund rose 340% from $3.5 million to $15 million, the highest level in 14 months.

In graphic form:

Again, this is unusual behavior, especially to this extent. Normally, flows will follow the market, except on a very short-term and small scale basis. Seeing money flow into the 3 tech funds like it did – setting 15-month to 15-year highs – raised our antennae. Such a rush into funds, even into strength, has often been a tip off to go the other direction. That’s because rarely are traders en masse correctly positioned when the position is at an extreme.

For example, the last time the Internet and Technology Funds saw their assets that high (early 2014), they each dropped about 10% over the subsequent few months. In the Electronics Fund, you have to go all the way back to September 2000 to see assets as high as they are now, and everyone knows what happened then.

While it is most pertinent to view these fund flows in relative terms, there is a point to make regarding the absolute level of dollars here. It is pretty small in the grand scheme of things. It is entirely possible, therefore, that the inflows came from a single trader or manager. If that is the case, then viewing the flows as a collective read on sentiment would likely be misguided. Furthermore, there would be at least a greater possibility of the trades being “smart money” moves, rather than automatic fades.

As we do not know the origin of the flows, we don’t know if they are big bets on behalf of a single manager or reflective of a general “buy-the-dip” mentality from the crowd. By default, we would automatically side with the contrarian viewpoint and mark the inflows as a negative for the tech sectors. However, given the unknown source, we wouldn’t necessarily back up the truck when assuming a position.

________

“Galatea” photo by Jason Mrachina.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.