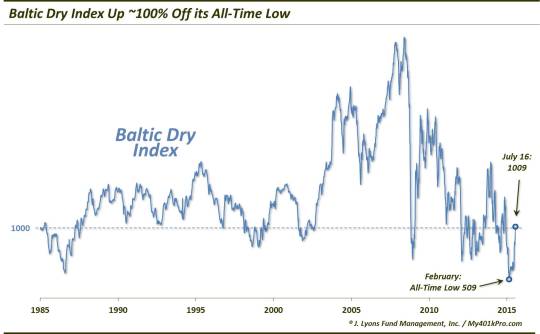

A Ray Of Light From Global Shipping Index?

The Baltic Dry Index has doubled from its February all-time lows.

On January 30, we wrote a post on the Baltic Dry Index (BDI), a composite of various global shipping rates tied to the movement of raw materials. At the time, the BDI had just dropped to a 30-year low. That wasn’t terribly surprising since the rates are largely determined by the prices of raw materials which, at that time, were in the midst of a deflationary spiral. And since the BDI is also considered by many to be an indicator of the level of global economic activity in general, the new lows were not a good sign for the global economy. And it was an especially poor sign for pricing prospects as a drop in the BDI is inherently deflationary.

Well, the cost of materials continued their spiral lower into the month of March. And as we now know, the global economy was indeed weakening during the 1st quarter. However, a strange thing occurred in the BDI. It did move lower for another 3 weeks into February, establishing an all-time low of 509 on February 18. But then it began to bounce…and bounce and BOUNCE. And while commodity prices have begun to collapse again in recent weeks, the BDI has continued up. As of yesterday, the index had made it all the way back above the 1000 level, essentially doubling from of its February low.

So is this a sign of hope for the shipping industry, and perhaps the global economy at large? And what of its contradiction in trend versus most commodities at the present time? Perhaps it will be a leading indicator of a pickup in economic growth. And perhaps it is signifying that the worst of the deflationary move in commodities is over. With many key industrial metals and commodities testing their early-year lows right now, that would be a most welcomed and timely development. Additionally, as we mentioned in the January post, the BDI has shown a close correlation with European equity markets. This positive move would marry well with our recent bullish view on Europe.

However, we’re not all that confident that there is a rosy message being sent here. In fact, the more we look at the BDI, the more apt we are to disregard it as an analytical input. For one, the 1000 level (its base price at inception in 1985) seems to be an equilibrium of sorts from either a supply-demand standpoint or merely a cycle standpoint. Notice on the chart how the level has acted as a magnet for prices over the past 30 years.

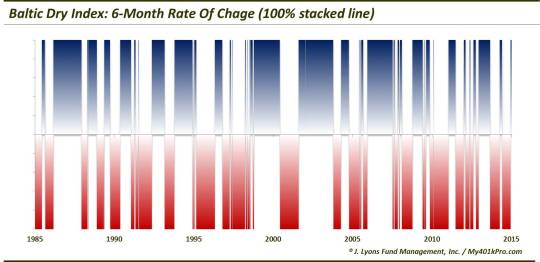

Furthermore, take note of how prices tend to cycle in the BDI, regardless of the exogenous environment. Outside of the commodity boom/bust of the mid-2000′s, there has been very little in the way of trends as it pertains to the BDI. Check out this chart of its rolling 6-month rate-of-change (all changes set to +/-100%).

Lastly, there is a break-even level in the BDI for shipping operators. That level is likely somewhere in the 500-600 vicinity where prices have held on many occasions since 1985. It should, thus, not be surprising that the rate has bounced from its February lows instead of drifting towards zero.

While the recent 100% jump in the Baltic Dry Index, on the surface, would appear to be a ray of light for global shipping activity, and perhaps the global economy at large, we are not so sure. Upon examination, the index appears to exhibit purely cyclical characteristics that outweigh the shorter-term economic and inflationary trends at a given time. Thus, it seems be more prone to “reversion to the mean” than a deep economic “meaning”. By and large, our conclusion is to dismiss its price movements as a global economic bellwether. What is it good for? Probably just determining the cost of shipping one’s raw materials.

__________

Photo of Pasha Bulker, run aground in Newcastle shortly before taking to sea again, by PJR.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.