Another Bullish Setup For Biotech?

While the post-2009 cyclical bull market has yet to run its course, there is a clear leader in the clubhouse in the race for poster child. The biotech sector has been an absolute juggernaut, going on a perhaps unprecedented streak. After leading the way in sector performance the past 2 years with 50% advances, it is on pace to do so again in 2015, up 25% just past the midway point. And while it is almost certainly a developing bubble, it doesn’t look ready to pop just yet.

A telltale sign of relative strength in a market segment can be found in how well it holds up in a broad decline – and how quickly it recovers. From both of those standpoints, the biotech sector does not appear ready to relinquish its relative strength. Despite its “high-beta” status, the sector held up very well in the recent market pullback, even holding above its June lows. It has also been quick to recover. Before yesterday’s market open we tweeted the following:

@JLyonsFundMgmt 5:22 AM – 13 Jul 2015 Details

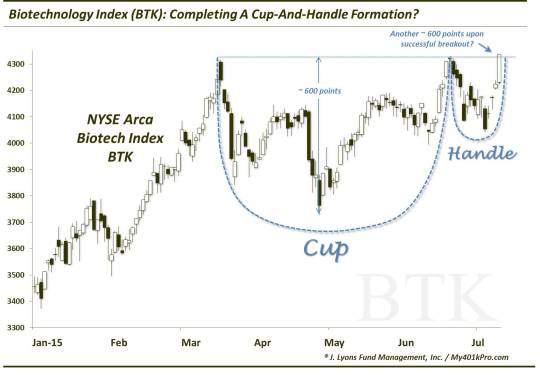

Biotech Index $BTK showing double-top…but could look very Cup-&-Handlish very quickly here…IMO

As of Friday’s close, the NYSE Biotech Index was roughly 3.5% below its highs of both March and June. Of course, for the biotech sector, that’s like a day and a half of trading.

Well, a day and a half later, the BTK is up 3.5% from Friday’s levels and challenging the prior peaks. It is also forming the “handle” of the “cup-and-handle” formation we mentioned.

So what is the significance of a “cup-and-handle”? It is generally a bullish chart pattern that often times leads to explosive moves higher. The gist is that after a relatively long, and normally “rounded” pullback from the original peak, prices return to hit the same level, forming the “cup”. Prices not surprisingly are repelled temporarily by the previous peak levels. However, they return to the peak levels again in relatively short order (the handle). The resiliency in prices to remain near the top of the range is a suggestion that they will eventually break through. Yes, there is a possibility of a triple top in such instances. However, we have found triple tops to be about as common as unicorns.

Importantly, in our view, it is best to wait for prices to break out before jumping aboard, i.e., don’t anticipate the breakout (however, one may not have to wait too long as the BTK is threatening to break out already). What is the upside target upon a breakout of a cup-and-handle? While we are not big on applying targets, there is a general rule of thumb that the upside potential should be roughly equal to the distance from the top to the bottom of the cup. The last time we mentioned a potential cup-and-handle in the biotech sector was in reference to the Biotech SPDR ETF, XBI last October. Indeed, after the XBI broke above the high of the pattern, it went on to double the range of the cup-and-handle, leading up to the March peak.

In the case of the BTK, the range from the top to bottom of the cup would be roughly 600 points (4326-3728). That would target about 14% above the top of the cup here and would bring the index up into the vicinity of the 5000 level which would be a nice round number target (that really isn’t relevant, but would be interesting – e.g., 2000 Nasdaq bubble top?).

Before we get ahead of ourselves talking about the popping of the biotech bubble, let’s stick with the facts at hand. Those facts continue to be nothing but bullish price action in the biotech sector. For all of the froth and silly money being thrown at the sector, its stocks continue to lead the way higher. And should the Biotech Index break out and hold above the potential cup-and-handle formation, it could run significantly higher still.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.