Oil Services Sector Again Testing Key Support (& Fate?)

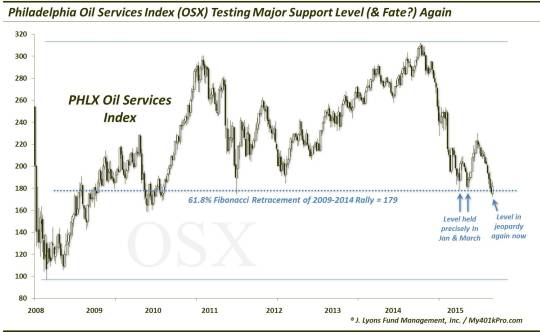

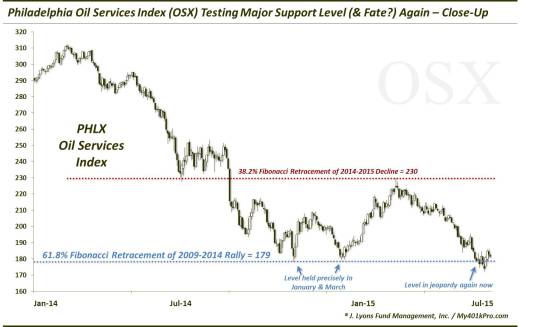

Back on March 19, we noted that the key Oil Services Index (OSX) was testing an important line of support. Specifically, it was the 61.8% Fibonacci Retracement of its rally from 2009 to 2014, at about 179. It had held that level precisely (178.37) in January before bouncing 16%. Sure enough, the OSX held the level in March – again, precisely (179.05) – leading to a near 30% rally. In the March post, we mentioned that any bounce to the 230 level may encounter resistance. Well, on May 5, the index spiked up to a high of 230.10…and immediately failed. Since then, it has erased its entire post-March gain and is once again testing that key 179 area. But while conditions surrounding the January touch (initial low) and March touch (re-test) suggested a decent possibility of holding, the OSX may be pressing its luck here with its 3rd trip to this level.

Here is a zoomed-in look at the developments.

Why do we say the OSX may be pressing its luck here in hoping to bounce again off the 179 level? As mentioned, the two touches of the level earlier in the year provided almost a textbook example of an initial low followed by a re-test. However, there is a reason that most technicians scoff at “triple” tops or bottoms. They just aren’t too common. Therefore, the OSX may be tempting fate here with its latest incursion to the 179 area.

Furthermore, various sister indexes of the OSX like the XOI Oil Index and the Dow Jones U.S. Oil & Gas Index have broken their lows of earlier in the year. In particular, the Oil & Gas Index has clearly failed to hold its prior lows and looks like it has begun another down-leg, although it is currently mounting an attempt at testing the breakdown level.

The fact that these indexes have already failed to hold support makes it easier to conceive of the OSX also failing.

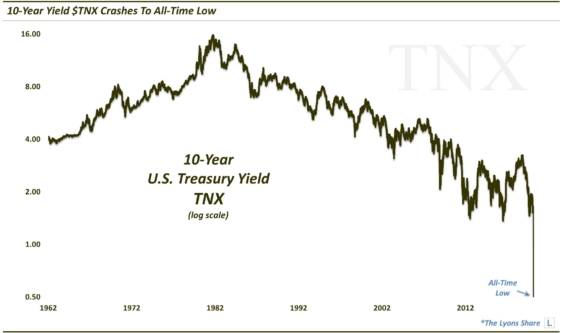

This post mirrors the one yesterday on the basic materials sector testing an important support level of its own. Obviously the next wave of the deflationary cycle has been triggered. In our view, that wave is at an important juncture as it applies to the resource/energy equity complex. Given the oversold status among those stocks, it would not be surprising to see these key levels hold, at least temporarily. However, despite the fact that this space is undoubtedly washed-out, a failure of current levels may be the eventual fate of these indexes. If that transpires, we could see this deflationary wave accelerate. And though the downdraft may not last long, it could produce steep losses quickly. It also could produce tremors among a broader equity market that is not in the most stable of conditions at the moment.

________

Photo from the Dallas News.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.