Another Rising Rates Tale Knocked Down

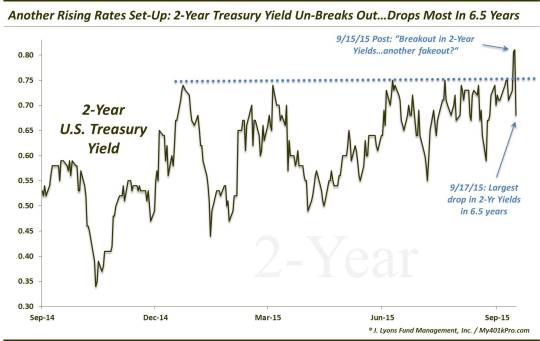

2-Year Yields see historic drop as Tuesday’s “breakout” once again proved to be a set-up.

“Then again, don’t be surprised if the nice-looking chart set-up is once again merely setting folks up before knocking rates back down again.” – Closing line in our post on Tuesday

They did it again. For the umteenth time in recent memory, investors were teased with a tantalizing tale of rising interest rates, only to have the rug pulled out again. This time, it was the 2-Year Yield that looked poised to possibly trend higher. In fact, the “breakout” in the 2-year was the subject of our Chart Of The Day way back on Tuesday. Adding to the intrigue of this version of the rising rates theory was the specter of a highly anticipated potential rate hike by the Fed.

Well, as we know now, the Fed did not hike rates. And we also know now that the potential breakout in 2-Year Yields failed spectacularly. Not only did Yields drop back below the breakout area today, but they dropped 13 basis points on the day, the largest drop in 6.5 years!

There are certainly a couple lessons to be learned here, both of which could have been found in that Tuesday post.

First off, don’t blindly follow the “obvious” market narrative.

The breakout in 2-Year Yields was heralded by many as a signal of a coming rate hike. Not surprisingly, that turned out to be wrong. We say not surprisingly because, as we wrote on Tuesday:

“while sometimes reading the market tea leaves is that easy, typically it is not. Why? Because not only is the market the world’s best discounter of information, it is also the best discounter of investor psychology. It instinctively senses when too many participants are leaning in one direction, either in their positioning or in their analysis.”

Secondly, don’t hold your breath waiting for the elusive rising rates. As we put it in Tuesday’s post:

For centuries now – okay, it’s only been a decade maybe – the vast majority of market observers have been expecting interest rates to trend higher. Yet, year after year, the market has made those people look silly as yields have continued to decline. Even on those occasions when the price action in rates themselves seemed to validate rising rate expectations, that rug was pulled in short order.

Well, chalk up another rug-pull. If it sounds like we are not surprised by the false breakout, we’re not. This isn’t exactly a “we told you so”…just passing along one of the countless lessons we’ve learned (and continue to learn) after many years in this business.

If you want to survive, there are only so many times you can allow yourself to get set up only to get knocked back down.

______

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.