Is Market Setting Stage For Rate Hike?…Or Just Setting Us Up?

Was today’s breakout in 2-Year Yields for real?…or another fakeout?

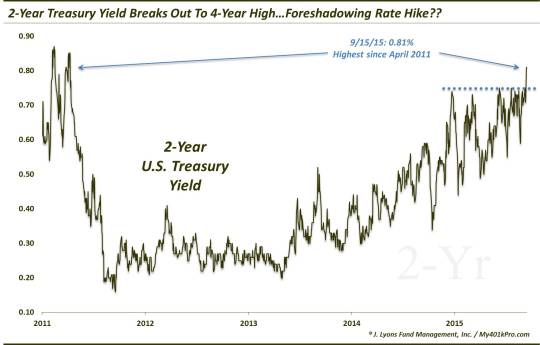

Of all the interesting story lines stemming from today’s market action, perhaps the most noteworthy was the action in 2-Year Treasury Yields. After an almost year-long trading range with a ceiling in the 0.75% area, 2-Year rates finally broke out today. Closing at 0.81%, the yield hit the highest level since April 2011.

Now, with the long-anticipated “will they or won’t they raise rates?” Fed meeting imminent, speculation is bound to be rampant regarding the meaning behind this move in 2-Year rates. Does this breakout in rates mean a rate hike is coming this week? Everyone knows the market is the world’s best discounting mechanism. Therefore, perhaps today’s move is an in-your-face answer to the question that everyone seems to be fixated on.

Then again, while sometimes reading the market tea leaves is that easy, typically it is not. Why? Because not only is the market the world’s best discounter of information, it is also the best discounter of investor psychology. It instinctively senses when too many participants are leaning in one direction, either in their positioning or in their analysis.

Look no further than the bond market for proof. For centuries now – okay, it’s only been a decade maybe – the vast majority of market observers have been expecting interest rates to trend higher. Yet, year after year, the market has made those people look silly as yields have continued to decline. Even on those occasions when the price action in rates themselves seemed to validate rising rate expectations, that rug was pulled in short order (e.g., the breakout in the 5-Year Yield in September 2014).

The set-up on the chart of the 2-Year Yield supported the current breakout. It had been forming an ascending triangle for the better part of a year, with parallel highs and higher lows. This pattern, more times than not, results in an upside breakout. Thus, this breakout is not a surprise. However, again, the market likes to eventually surprise participants who claim not to be surprised.

Therefore, perhaps this breakout in the 2-Year Yield is a precursor to a rate hike and the long-awaited rise in yields. Then again, don’t be surprised if the nice-looking chart set-up is once again merely setting folks up before knocking rates back down again.

______

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.