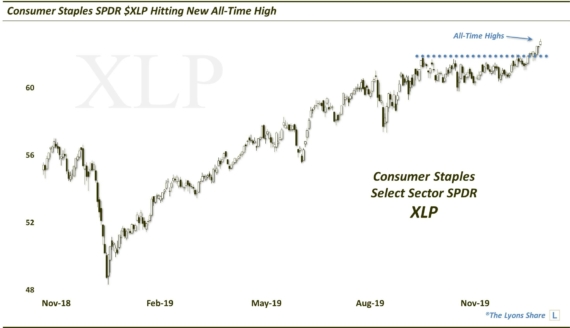

Boring Staples Sector First To The New High Finish Line

It may not be the flashiest sector, but consumer staples stocks are the first to score a new high following the recent decline.

While the flashy “hares” of the technology sector, e.g., Google Alphabet, Amazon, Microsoft, etc., are busy garnering all of the headlines, perhaps the most mundane of sectors was actually the first to reach a “finish line” of sorts. The consumer staples sector closed at an all-time high yesterday, making it the first major index or sector to reach that milestone following the July-September correction.

Here is the popular Consumer Staples Sector SPDR ETF (XLP) yesterday, exactly matching its all-time high close of 50.82 set on August 5. This chart is not adjusted for dividends either, so its adjusted price is easily at a new high.

Even more impressive is the Rydex Equal Weight Consumer Staples ETF (RHS). It closed yesterday over 1% above its former all-time high of August 5. This too is on an unadjusted basis.

The noteworthy thing about the all-time high in the equal weight RHS is that it means the strength in the sector is rather broad-based, not just concentrated in the biggest issues. We touched on some of the biggest names in recent posts (including Monday’s “Vice stocks” post) and tweets, such as McDonald’s, Coca Cola, Altria, etc. that have been performing extremely well lately. But apparently it’s not just the biggest stocks.

What is important about consumer staples reaching the “new high” finish line first? A few things. First, as it pertains to the staples sector, it is extremely bullish. Following steep corrections, it is instructive to see which sectors and market segments can reach new high ground first. Those are very often your leaders in whatever subsequent rally unfolds.

Additionally,

as we have been trumpeting, as it pertains to the rally in general, it is important that something made it back to new highs. With the questionable secular and developing cyclical backdrop to the market, there is a real possibility that the recent selloff marked a dagger of sorts to the post-2009 bull market. If that was indeed the case, the resulting bounce, i.e., the current one, is in danger of being merely a “mean reversion” bounce. In other words, a bear market rally to lower highs.

That bear market rally possibility still remains. However, the fact that a major market sector has made it back to new high ground – and so quickly – gives hope that the bounce will evolve into something more substantial. And with some of the technology areas into, or threatening, new highs today, there becomes a greater chance of a more substantial and longer continuation of the rally. Now this continuation does not guarantee that all market segments will return to their highs, or even participate further at all. It may in fact be an early-stage bear market rally. However, the odds are better now, with some leadership sectors in the fold, that a more substantial rally will persist in at least a significant swathe of the market.

There is one caveat to the leadership of the consumer staples. There is ample evidence that the sector is a late-stage bull market leader. One must only look to the last 2 cyclical peaks when consumer staples stocks performed very well through 2000 and even well into 2008. While that leadership was great for the sector, it did little to ward off developing bear markets in the broader market.

For now, however, it is a victory for the stock market that a major sector has reclaimed high ground. And it is obviously a victory for the consumer staples stocks, specifically, even if it has gone largely unnoticed amid the “hares” bouncing 10% in a day. However, consumer staples bulls would probably prefer it this way. The tortoise can cover a lot more ground if nobody notices it.

_______________

“Galapagos Tortoise Walking Along Road 4” photo by Amaury Laporte.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.