Internet Stocks Demonstrating the ABC’s Of Relative Strength

Internet stocks, which have demonstrated relative strength throughout 2015, are continuing their strength into year-end.

If you “google” the term relative strength, you’ll come across a bevy of articles and papers espousing the concept of investing in strong performing stocks, funds, etc. There is a wealth of research and data supporting the persistence of relative strength, or momentum, in the stock market. Indeed relative strength constitutes the hallmark of our investment selection model.

Of course, the challenge is in constructing a model or parameters to identify relative strength leaders that are likely to continue to perform well, rather than simply “flash-in-the-pan” securities. Furthermore, on the other side, one has to design parameters for instruction on when such relative strength may be waning and it is advisable to jettison such positions.

Thus, the concept has its challenges, as all investment strategies do. However, we have found it to be vastly superior to the opposite philosophy of attempting to buy “oversold” or “undervalued” names. While certainly some investors have been successful at implementing that strategy, in our experience, it has been a fool’s game. Trends persist on the downside as well, so cheap usually gets cheaper and oversold gets more oversold. And while relative strength does not always work, at a minimum, it can help you avoid the worst case scenarios that often result from buying “cheap” stocks.

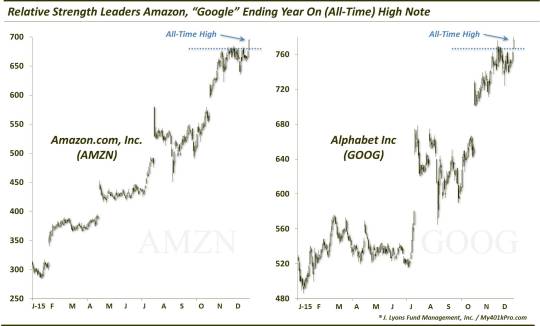

Now, if you google a recent post or entry for “relative strength”, you might find a picture of…Google (now, Alphabet Inc.), ticker, GOOG. That’s because GOOG has been a relative strength leader for much of the year. And like its fellow internet stock Amazon Inc. (AMZN), that strength is persisting through the final days of 2015. In fact, the 2 stocks both closed at all-time highs today.

Of course, these 2 stocks represent half of the F.A.N.G. group that has become famous for its persistent strength over the past few years. And while the moves in a few of them may seem extraordinary, do not be surprised at the persistence of their uptrends.

Relative strength areas will experience ups and downs like anything else. However, as long as the ups keep making new highs, the lows are making higher lows and the stock is advancing at a stronger overall clip than its peers, the relative strength may persist. For example, while we do not trade individual stocks in our practice, internet funds have been on our radar for some time. When the market corrected in August-September, internet stocks were not immune to weakness. However, on a relative basis, they held up better than other sectors and maintained their relative strength status (see our September 30 post: Taking A Long Look At Internet Stocks).

If you’ve long been attempting the “buy cheap stocks” strategy and have come away with frustrating results, perhaps it’s time to give relative strength a try. I know it may seem counter-intuitive to buy stocks that are already up, perhaps even a lot. But as the late Martin Zweig stated, “The idea is not to try to buy low and sell high. That’s preposterous. The idea is to buy when the odds are greatest that the stock you are buying will go up.”

Leave it to a stock named Alphabet to demonstrate the “ABC’s” of that philosophy.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.