Is Flattening Yield Curve Signaling Recession?

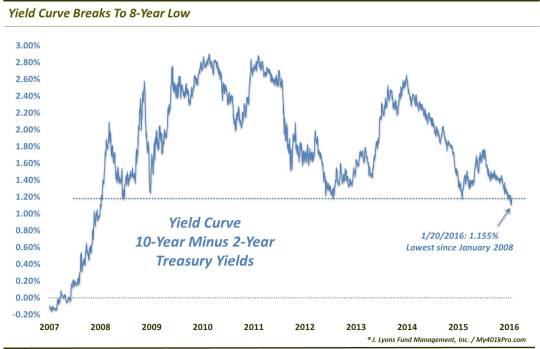

The yield curve just dropped to 8-year lows; but it isn’t necessarily flagging a recession, yet.

With the carnage in the equity and commodity markets, the bond market has somewhat flown under the radar lately, at least outside of the high yield space. That is a far cry from the buzz of a month ago when the Fed hiked interest rates for the first time in 9 years. However, there are a few interesting developments taking place in the space. Probably the most interesting of which is the drop in the yield curve over the past few days to the lowest level in 8 years.

By yield curve, we are referring to the spread between the 10-year treasury yield and the 2-year treasury yield. Generally, a steeper (and steepening) yield curve (i.e., 10-year yields are higher and increasing their margin above 2-year yields) is a signal of economic strength. Conversely, when the yield curve is flattening, it can be a sign of economic weakness.

With the drop to an 8-year low, the yield curve has many folks nervous about its potential signal regarding the economy, more specifically, the threat of recession. Given that, we took a peak at the yield curve over past 40 years to see if there is any justification to these fears.

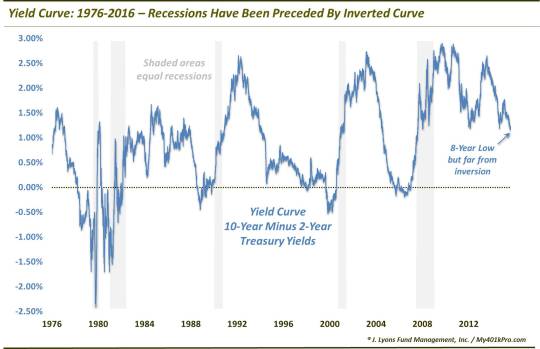

We have looked at this in the past and concluded that, to the extent that history is any indication, recession fears become valid only when the yield curve becomes inverted, i.e., when the 10-year yield drops below the 2-year yield. Re-visiting the topic, we would have to conclude the same thing. Looking at all of the recessions of the past 40 years, one common element is that they were all preceded by a drop below 0%, or inversion, in the yield curve.

With the yield curve sitting at 1.155% as of yesterday, there is a healthy buffer still above the inversion zone, despite the recent breakdown. Now, we are thankfully not economists and there may be plenty of reasons for concern over the pace of economic growth (in our amateur opinion, we think there is plenty to be concerned about). However, the yield curve is not of of those immediate concerns.

Of course, it’s not just about where the curve is but where it’s headed that matters. If it continues to drop sharply, then the recession fears may become justified. Interestingly, the past 3 times the yield curve dropped this low, it continued on an almost direct path to inversion. So that is perhaps something to keep in mind.

Lastly, one has to wonder about the timing of the Fed’s rate hike, given the proximity of the yield curve. Yes, the breakdown is only a very recent occurrence but it has been threatening for some time. And while we do not believe that rates should be at 0%, it was an awfully curious spot for the first rate hike in 9 years.

In summary, there may be plenty of red flags out there regarding the strength (or lack thereof) in the economy. Strictly going by historical precedent, however, the yield curve is not one of them – not until it approaches inversion.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.