It’s Groundhog Day Again For The Rising Rates Crowd

Yet another attempt at rising interest rates has spectacularly fizzled out.

Well, once again the critter popped its head above the surface before promptly returning to its familiar territory down in the depths. I am, of course, referring to U.S. Treasury yields. After a decade of consensus forecasts for rising rates, and countless head-fakes higher along the way, one would think that market participants would have learned their lesson by now as it pertains to expectations for rising rates. Yet, if I can mix metaphors, like Charlie Brown, they keep flailing at that football only to see Lucy yank it away every time.

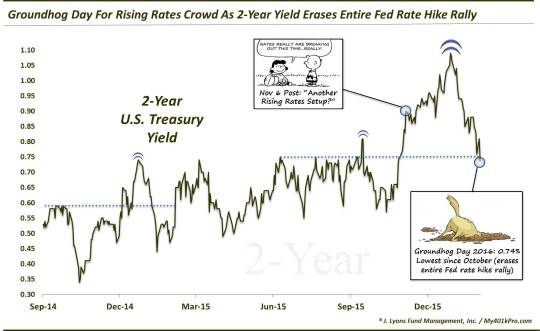

We last covered the topic on November 6, 2015, specifically relating to 2-Year Treasury yields. At the time, the market was beginning to price in the likelihood of the first Fed rate hike in 9 years and the 2-Year was undergoing its most convincing “breakout” in years. Still, we cautioned investors that (like Bill Murray in Groundhog Day”), we’ve seen this drill many, many times in recent years. Indeed we concluded with this warning (along with the accompanying cartoon):

if you are leaning heavily towards a new “rising rate” regime: watch out that Lucy doesn’t yank that football away again.

The warning has, not surprisingly, been validated. After rates continued to rise through the time of the December rate hike and toward the end of the year, they have since pulled an about-face. And, in fact, the 2-Year yield has come all the way back to the spot (around 0.74%) from where it launched its year-end rally. Thus, for all of the effort spent by prices (or by pundits) toward the notion of rising rates, the 2-Year yield is essentially no higher than it was a year ago.

What’s the moral of this story? How about, stop expecting rates to rise. Yes, the Fed can have a demonstrable effect on the short-end of the yield curve especially. Therefore, if they continue their campaign of raising rates, we may actually see short-term rates rise for longer than 2 months. However, that is not our expectation.

Longer-term yields seem even less likely to rise, given the less-than-stellar state of the economy, as well as the considerably lighter influence on the part of monetary policy. The only factor in favor of rising long-term rates, in our view, is a cyclical one. There has been a distinct, approximately 54-year cycle in interest rates going back hundreds of years. This cycle is overdue to bottom now, by a couple of years, no doubt delayed by the actions of central banks.

However, in our opinion, some entities (e.g., the economy and market) are too vast and momentous to be permanently sidetracked by exogenous forces. Therefore, while these long-term cycles are not pin-point accurate, we are squarely in the bottoming “window” right now.

That said, while we could be wrong, we cannot yet foresee what would cause rates to rise significantly anytime soon. Plus, we like to stick with the trend. Therefore, while it was forgivable to have been duped by Lucy’s rising rates ball trick once or twice years ago, at some point folks have to stop falling for it. Otherwise, it’s likely to continue to be Groundhog Day over and over and over, etc….for the rising rates contingent.

______

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.