Any SILVER Lining To Decade High “Smart Money” Shorts?

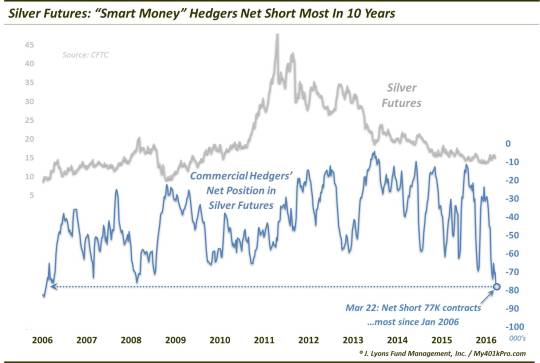

Commercial Hedgers are at their largest net short position in silver futures in over 10 years.

We’ve talked about the CFTC’s Commitment Of Traders (COT) report on occasion in the past. To refresh, the COT tracks the net positioning of various groups of traders in the futures market. One such group is comprised of Commercial Hedgers. As their name implies, their main function in the futures market is to hedge. By definition, therefore, they typically build up positions contrary to the prevailing trend. As a result, this group is typically correctly positioned (and extremely so) at major turning points in a market. It is for that reason that the group is usually referred to as the “smart money”.

In a development similar to that which occurred last October (fyi, this post mirrors one from back then almost verbatim), Hedgers’ current net position in silver futures could reasonably be considered “extreme” – on the short side. That is because these Hedgers are net short the most silver contracts in more than 10 years.

Specifically, Hedgers were net short 77,242 silver contracts as of March 22. That is their largest net short position since January of 2006. This is somewhat startling, really, considering the price of silver experienced a veritable parabolic blowoff from 2010-2011.

And it is also likely not a good development for silver bulls. There are certainly challenges to using the COT data as investment guidance. For one, these Commercial Hedgers are not always correctly positioned at key junctures, as we have seen recently in the Euro currency futures. Secondly, extremes in positioning can always get more extreme, as price continues in its prevailing trend.

Therefore, it is entirely possible that the price of silver continues to climb in the near-term as the Hedger short position presumably gets larger. However, the current positioning would not be on my wishlist if I were a silver bull. I would rather take a stab long-side when the Hedgers were on my side – and the Non-Commercial Speculators (on the other side of Hedger positions) were closer to net short.

Particularly concerning for bulls, perhaps, is the eagerness to rush in to the long side on the part of Speculators, in the context of a solid but unspectacular rally. Yes, the metal rallied over $2 (~15%) from its December lows. However, in the context of a $35 decline over the past 4 years (>70%), that does not seem to be a move commensurate with such a large net-long build on the part of Speculators.

Again, the COT analysis is more art than science. The metal has gotten demolished and it certainly could bounce further in spite of the large Hedger short. If it does, it would probably be a good longer-term sign for the metal. However, that is a small, rather subjective silver lining for bulls as it pertains to the COT positions.

It would have been much more preferable for silver bulls had Speculators been more skeptical and slow to buy into the rally – literally and figuratively. Unfortunately for them, however, such a wall of worry is hardly descriptive of the current environment.

__________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.