Is “Most Important Asset” Signaling Major Risk-On Potential?

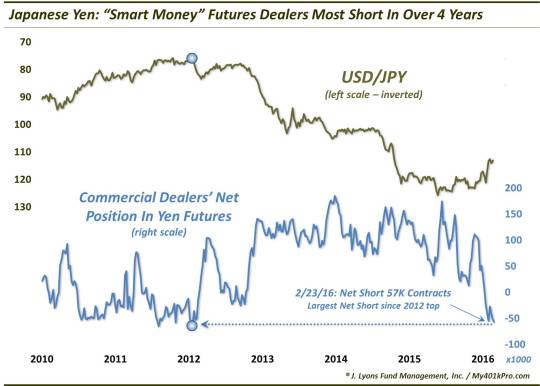

“Smart money” Commercial Hedgers have not been this heavily short Yen futures since the 2012 top that preceded a 40% decline.

It’s not our view that there is one asset class whose price action directs that of all the other asset classes. If it were true that the movement of A determined the outcome of B, C and D, one would need only analyze A. As we know, however, relationships between various assets are not static. They are dynamic, i.e., always changing. That is why when we are analyzing an asset, we do so based on the merits of that asset alone, rather than speculating on the influence that some other asset is likely to have on it. It is challenging enough to try to “figure out” what B is likely to do. It makes little sense to us to try to figure out what B is likely to do based upon on what A is likely to do.

Despite that, if you polled investment strategists on Wall Street, or on social media, many would likely disagree. And one asset that we suspect would get plenty of votes in the category of “most important asset” is the Japanese yen. The reason for that is because over the past several years, the currency has been the poster child of the so-called carry trade. What does that mean? Essentially it means borrowing money somewhere at a low (and likely to stay low) interest rate and investing the proceeds somewhere else that pays (and is likely to continue to pay) a higher return.

And nowhere has central bank policy seemed more determined to keep interest rates low – and, thus, the currency devalued – than in Japan. As such, the yen has been the currency of choice for “carry traders” for some time. Because of that, the price action in the yen has seemed to be the best barometer of global “risk-on” versus “risk-off”. When the yen was falling, it signaled confidence on the part of traders that the rates in Japan would remain depressed and they were free to deploy their borrowed money on various risk-on assets elsewhere. Conversely, when the yen has rallied, it has supposedly been a sign of the carry trade “unwinding” – thus, necessitating the selling of one’s risk-on assets.

While the global financial system is more complex than that linear relationship, there is nonetheless plenty of truth in application to the theory. For the most part, as goes the yen over the past several years, so goes the carry trade – and risk-on assets. For example, the relationship between the yen and equities has been very tight (on an inverse basis) over the past 4 years. When the yen has dropped, stocks have rallied – and vice versa – in a very consistent manner. As evidence, the yen bottomed last May coincident with the top in stocks (as a matter of fact, despite the perceived tailspin in the yen, the currency is actually higher than it was 16 months ago.)

So is there indication that the yen’s positive stagnation will soon end? A resumption in the currency’s decline would certainly be welcome news for risk asset bulls around the globe. Luckily for them, there is at least one data point that would seem to support a potentially significant decline in the yen. It comes from the futures market.

We’ve talked about the CFTC’s Commitment Of Traders (COT) report on occasion in the past. To refresh, the COT tracks the net positioning of various groups of traders in the futures market. One such group is comprised of Commercial Hedgers, or Dealers. As their name implies, their main function in the futures market is to hedge. By definition, therefore, they typically build up positions contrary to the prevailing trend. As a result, this group is typically correctly positioned (and extremely so) at major turning points in a market. It is for that reason that the group is usually referred to as the “smart money”.

At present, these Hedgers’ net position in yen futures could reasonably be considered “extreme” – on the short side. That is because they are net short the most yen contracts in more than 4 years. The last time they were shorter than they are now was January 17, 2012. The yen proceeded to lose 40% of its value over the next 3 years.

Now a word of caution: a yen decline is not a slam dunk, despite this data point. A few things to consider:

- Extremes in COT positions can always get more extreme. Thus, while a 4-year high in net shorts certainly seems extreme, it is possible that it is headed toward a much larger net short – and a possible further rally in the yen – before it leads to a meaningful yen decline.

- Along those lines, it is also possible that the market has entered a regime change in which, again, COT extremes can grow larger…and can stay extreme for some time before a significant reversal in the underlying. For example, note that Hedgers were extremely net short for much of 2010 and 2011 before the yen topped. Likewise, they were substantially net long for much of 2013-2015 before the position paid dividends.

- As mentioned earlier, market dynamics are constantly changing. Thus, it is possible (but perhaps not likely) that the yen loses its favored “carry trade” status. In that case, it could be that the yen resumes its decline, as suggested by the COT positioning, but fails to ignite a rally in risk-on assets.

- Lastly, although the futures Hedgers’ extreme net short position would augur for a reversal lower in the yen, it is not really a catalyst on its own. The position more accurately indicates the potential amount of fuel available in the event that the yen does indeed turn lower. Still, the yen would need some sort of a trigger to initiate the decline and tap all that potential fuel.

So, what’s our takeaway? The net short positioning on the part of futures dealers does mark a reasonable extreme. The fact that they are usually correctly positioned at significant junctures suggests that the yen is vulnerable to a new, and substantial, decline. Such a move is not necessarily imminent, however, as it will require a catalyst to unleash that potential fuel.

Would this potential downdraft in the yen spur a major risk-on rally around the globe? While we are in the camp that a new cyclical bear market has begun in the U.S. stock market, that does not preclude bouts of fierce rallies. And while we have emphasized the fact that market dynamics are constantly in flux, we don’t yet see enough evidence to suggest that the carry trade relationship involving the yen is dead. Thus, while we are not longer-term bulls, it is certainly possible that a futures-fueled yen decline could contribute to a solid intermediate-term rally in risk assets.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.