Revenge Of The Median Stock

The median stock, as measured by the Value Line Geometric Composite, pummeled its large-cap peers this week; unfortunately, historically that has not necessarily been a harbinger of good returns going forward.

We spent much of 2015 harping on the underperformance of the broad market versus the cap-weighted large cap indices. In fact, our Chart Of The Year illustrated how the median stock, as measured by the Value Line Geometric Composite (VLG) had double-digit losses last year while the S&P 500 barely closed in the red. Our concern was that the broad based weakness below the surface would leak into the entire market, setting up a potentially substantial decline. That concern appeared well-grounded as 2016 saw the weakest start to a year in history. Since then, of course, stocks have mounted a comeback and, thus, it remains to be seen whether the weakness will be eventually sustained or merely a temporary scare. Our vote is for the former.

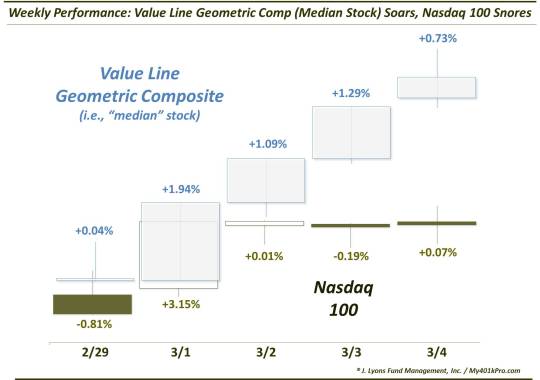

That said, this week brought some good news for the median stock as the VLG actually scored its best week in 5 years. But for a late-day selloff today, the index would have gained at least 1% the last 4 days of the week. On the other hand, the Nasdaq 100 (NDX) large-cap index did not share in the good times. As our Chart Of The Day reveals, the NDX closed essentially unchanged or down the final 3 days of the week. Quite a turnaround for the median stock versus its bigger peers.

As we have complained extensively about the poor breadth in recent times, we will be the first to celebrate this positive show of the internals. However, before one gets too giddy about the potentially positive ramifications of this positive breadth imbalance, a historical look does not support such giddiness.

Since our NDX data only goes back to the early 1990′s, we looked at the Dow Jones Industrial Average for historical precedents when the VLG outshone its big-cap peers by such a large margin. Specifically, we looked at all days since 1969 when the VLG gained at least 1% on the day and the DJIA fell. As it turns out, there have been 25. The returns in the VLG have not exactly been stellar.

What is the reason for these poor returns? Isn’t positive breadth a good thing. Yes, but I’m not sure it’s really all about positive breadth in this case. Many of these days occurred during volatile markets, i.e., bad markets. And several times, it seemed like an example of the VLG merely playing catch-up to the DJIA following a bout of underperformance. We have to consider that our present case may merely be another example of that.

Therefore, while the positive breadth and outperformance by the broad, “median stock” VLG of late is a good thing, the fact that it had so much ground to make up takes much of the wind out of the possible positive sails in this case. Furthermore, it may unfortunately be sending a message about what kind of market we are in, i.e., a bad one.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.