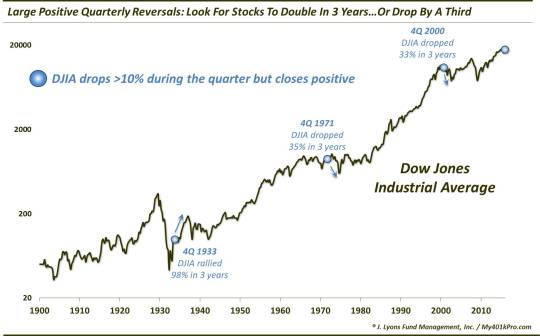

Stocks Should Double In 3 Years (…Or Drop By A Third)

Following stocks’ big reversal off their quarterly lows, historical precedents suggest the market will be up 100% in 3 years…or down 33%.

In our April 1st Chart Of The Day, we showed that the Dow Jones Industrial Average (DJIA) did something that it has only done 3 other times since 1900. After dropping over 10% during the quarter, it recovered to close the quarter positive.

The 3 prior quarters that saw the DJIA accomplish this feat were the 4th quarter of 1933, the 4th quarter of 1971 and the 4th quarter of 2000. Following these reversals, the index had some interesting returns over the subsequent 3 years: it was up a lot…or it was down a lot. After the 1933 occurrence, the DJIA rallied as much as 98% over the next 3 years. Following the 1971 and 2000 events, the index dropped by as much as 35% and 33% in 3 years, respectively.

So which will it be this time? The size of the deficit that stocks overcame in the 1st quarter may give us a clue. At its low, the DJIA was down -11.3% for the quarter. Looking at the prior reversals, we see that the DJIA’s max intra-quarter loss in 4Q, 1971 was -10.9% and in 4Q, 2000 it was -10.1%. The max drawdown in 4Q, 1933 was…-11.3%, exactly the same as this past quarter.

Therefore, bulls can take heart in the fact that our prior circumstances are more similar to the 1933 event. And if history is to repeat, we should expect the DJIA to nearly double over the next 3 years to around 35,000. Of course, we can never be too sure, so we would recommend adjusting one’s portfolio to take advantage of both potential scenarios.

Did I mention it’s April 1?

In all seriousness, one thing that may be instructive about such reversals is the overall investment climate in which they occur. The three prior events took place within secular bear markets. Additionally, there were 26 other quarters since 1900 which saw the DJIA recover at least 8% off its quarterly low after being down at least 10%. All but 2 of those quarters (4Q, 1987 and 4Q, 1997) occurred within a secular bear market.

Therefore, if there is anything that is to be gleaned from such large positive reversals, perhaps it is that they tend to occur within negative secular environments.

__________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments. Specifically, while the facts in this post are accurate (to the best of our knowledge), the analysis contained in the first 4 paragraphs are intended as April Fool’s parody.