Biotechs Building Base?…Or Bursting Bubble?

The bruised and bloodied Biotech sector is testing a trendline that may determine whether it has one more bull bounce – or if its bubble has burst.

Today’s Trendline Week feature takes us back to the U.S. to look at one of the, er, trendiest indices in the stock market. After covering Europe on Monday, Japan on Tuesday and back to Europe (specifically, Germany) on Wednesday, today we look at the oft-debated and controversial Biotechnology sector. Bear in mind that we are not picking these markets because of their prominence or popularity, but because they currently offer the most compelling trendline events in the market, in our view. That includes the Biotechs where we see the sector’s premier index testing a crucial level of support.

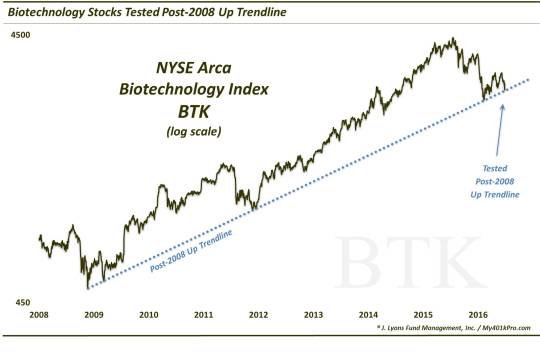

Like several of the other trendlines we’ve looked at this week, the NYSE Arca Biotechnology Index (BTK) is presently testing the key trendline supporting its post-2008 cyclical bull market.

As the chart illustrates, the trendline in question (drawn on a log scale) originates in November 2008 and connects the lows in March 2009, November/December 2011 and this past February. Again, we have mentioned on several occasions that the increased frequency (i.e., decreased time lapse) of trendline touches is often a harbinger of a forthcoming trendline break. If that is the case here, we can expect to see the trendline give way sooner than later.

On the other hand, we suppose it could be argued that the drop down to the trendline this week was merely a “re-test” of the BTK’s February low. That seems like a stretch to us, but anything is possible. Even if this is a re-test, however, one would expect prices to at least approach the February lows in a closer fashion than they have thus far. That February low sits at around 2575. The recent low in the BTK was 2807, a good 9% above February’s levels. The problem is, the trendline sits right at 2800 today, so a true test of the February low would necessarily violate the trendline, Even if such a breach was temporary, it will still serve to weaken the uptrend.

We mentioned Biotech’s status as “controversial”. By that, we are just referring to the much debated discussion about whether the sector is characterized by a “bubble”. Our thought, based on the parabolic price appreciation and frenzied inflows of investor money it attracted in recent years, was that it was indeed a bubble. The next question is whether the July 2015 peak marked the bubble’s bursting or whether the sector’s got another run to new highs left in it.

Considering it would take a 30%+ rally to get to all-time highs, the sector has its work cut out. Thus, we are guessing that the top is in. However, another leg up can never be ruled out. Some would argue that the post-February action in the sector is a base-building phase that will serve as the launch for that next leg up. That too is possible. However, our view is that cycle patterns would suggest one more wave lower (the third following July-October and December-February) before any substantial rally transpires. Even then, the rally would likely be a counter-trend move that would fall well short of all-time highs.

All that is conjecture at this point, though. If one is looking to play the Biotech sector, long or short, we view the post-2008 Up trendline as an important demarcating line. Hold the line (as it has since its touch on Monday) and immediate upside is more likely. Break below the Up trendline, and another wave lower is probably in the cards.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.