“Rising” Rates Hit New Lows

Despite ubiquitous calls and expectations for rising interest rates, yields on the long bond closed the week at a 52-week low.

It was probably over 10 years years ago when we first started getting calls from mutual fund wholesalers pushing their inverse bond funds. Their spiel was that, with interest rates at 40-year lows following a multi-decade rally in the bond market, rates had nowhere to go but up. To be honest, as contrarian as we like to think we are programmed to be, it didn’t seem like a reach to expect rates to soon begin to move higher. If forced to make a 10-year bet on the direction of interest rates at the time, you can be sure that bet would have been for higher rates. And it would have been a comfortable bet. The yield on the 30-year treasury bond back then was around 5%. Today, it is half that.

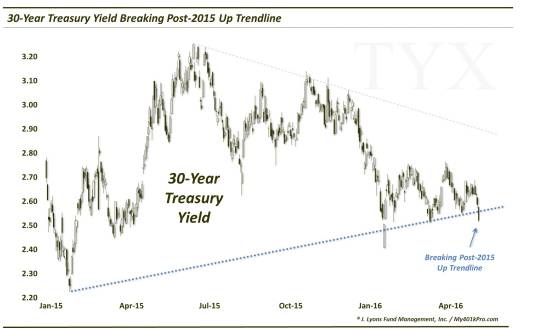

It is the comfort level that probably should have tipped us off that rates didn’t “have to” rise. That and the fact that it was the consensus thinking. Now, we might be slow, but we’re not the slowest. Thus, in recent years we’ve gone against the grain, remaining consistently in the “lower for longer” camp regarding interest rates, both short and long-term. Apparently, that is still “non-consensus”. That’s because, in light of one of the biggest Non-Farm Payroll misses in recent memory, the 30-year yield dropped today to 2.517%, a new weekly 52-week closing low. In the process, it also broke down below the Up trendline stemming from the January 2015 all-time lows.

The fresh break of that 16-month trendline (the lower bound of a 2-year symmetric triangle) suggests even lower yields to come as well. Although, zooming out a tad, we see that the close in the 2.50% vicinity may not necessarily clinch an easy immediate path for bond bulls. As this next chart shows, the 2.50% area served as major support for 30-year yields over the last 7-8 years. Rates bottomed in that vicinity during the 2008 financial crisis and the 2012 Eurozone crisis as well as in early 2015 and early 2016.

Now, we have often said that the more times a level is probed, the weaker it becomes as support or resistance. It is especially true when the length of time between touches gets shorter. Thus, we would not be surprised to see A) yields attempt to stabilize at the 2.50% level, but B) eventually break lower.

Now there are some ancillary factors that have recently begun to lessen our conviction of indefinitely lower rates and we hope to touch on those in the near future. Specifically, we are referring to long-term rates which are set by the marketplace, not Fed Funds which are established by the Federal Reserve. There is no telling what a limited collection of central bankers may decide to do – although, based on the chart of bank stocks (which were bludgeoned today), we recently cautioned against the growing consensus expectation for a June rate hike.

However, for now, as was the case 10 years ago – and 20 years ago – the trend in interest rates continues to be lower…”rising rates” crowd be damned.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.