Euro-PIIGS Are Squealing Again

After a several year reprieve, the stock markets of Europe’s “PIIGS” countries are breaking down again.

Precisely 4 years ago, in the summer of 2012, the financial world was fixated on the European continent. At the time, risks posed by the economically-challenged countries affectionately known as the “PIIGS” (i.e., Portugal, Ireland, Italy, Greece and Spain) threatened to bring the Eurozone’s financial system to its knees. And just as the continent appeared to be on the brink, ECB president Mario Draghi delivered his infamous “whatever it takes” speech, pledging the bank’s resources in fighting the financial crisis. That moment turned the tide for European equities as they would stave off collapse and stage a furious rally (more realistically, the markets were simply ready to rally as Mr.Draghi had certainly uttered plenty of supportive remarks previously).

As it happens, the PIIGS markets would enjoy the strongest rallies, not surprisingly, as they were the most beaten down. What may be surprising is the fact that the rally would last 3 years, an inconceivable notion at the time. However, that’s the nature of markets. They will more often than not surprise most people as the positioning of “most people” often dictates that the path of least resistance is to move away from that crowd.

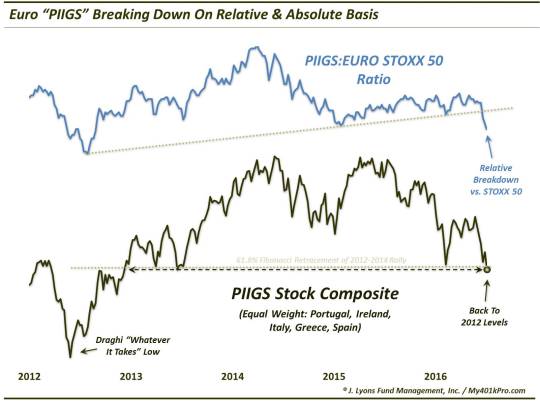

Last summer, however, it became clear that the honeymoon was over. The Portuguese and Greek stock markets had topped in 2014 and Italy and Spain would peak in the spring-summer of 2015. By far the most resilient of the 5 was Ireland, which saw its stock market hang tough until the start of 2016. Collectively, the group would put in essentially a double-top in the summers of 2014 and 2015. At least they did based on a composite of the PIIGS markets that we constructed several years ago in order track the group’s behavior.

Currently, this PIIGS Composite has folks experiencing flashbacks of the events of 4 years ago. That’s because the index has just fallen back down to levels last seen near the end of 2012. Furthermore, on a relative basis versus the more stable Dow Jones Europe STOXX 50 Index, it has also suffered an unambiguous breakdown recently.

Interestingly enough, the 61.8% Fibonacci Retracement of the 2012-2015 rally sits precisely at the level of the post-2012 lows in April and June 2013 and February of this year. This is only one example, but considering this PIIGS Composite is an untraded creation of ours, it does suggest that patterns such as Fibonacci are naturally occurring forces in markets, rather than merely self-fulfilling phenomenons.

So what are the ramifications of these developments? Rather than reinvent the wheel, we will close by repeating what we said in a post during similar circumstances last February.

The PIIGS Composite weakness is not just significant on an absolute basis. As the chart shows, it is also breaking down on a relative basis versus the DJ Euro STOXX 50, a proxy for the more established, “blue chip” stocks in Europe. Like all higher-beta sectors, stock market bulls want to see the PIIGS outperforming the lower-beta blue chips. That can be an indication of a willingness of investors to take on risk, a healthy condition for a bull market. In other words, when the PIIGS are outperforming, it is symptomatic of a “risk-on” environment. Conversely, when they are lagging, it is a sign of “risk-off”.

As the chart indicates, risk-off is decidedly the case at present as the PIIGS:STOXX 50 Ratio just broke sharply lower, through a shallow multi-year uptrend. Looking at prior trend breaks in the ratio, e.g., mid-2008, late-2009, and mid-2014, we see that substantial bouts of weakness ensued throughout European markets, particularly in the PIIGS. These also led to scares among some or all of the PIIGS pertaining to their economic viability.

This is not a pretty situation shaping up for the Eurozone once again. Whatever benefit that accrued as a result of “whatever it takes” may have largely run its course. Again, it will not be a straight line lower. However, the absolute and relative breakdowns in the PIIGS Composite suggests that the post-2012 run-up is over. Thus, while the PIIGS rally of the past several years may have tasted like Jamon Iberico and Prosciutto di Parma to investors, they may have to settle for scrapple and spam from any rallies in the near future.

__________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.