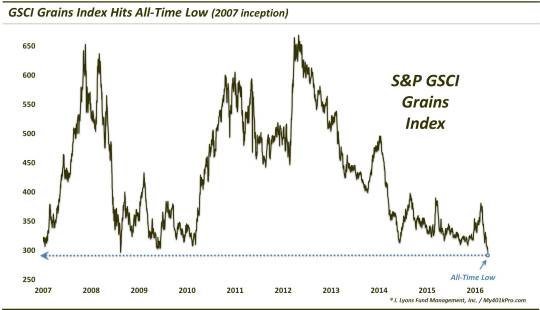

“Drought” In Grain Prices Reaches Historic Depths

An index of grain prices just hit the lowest level in its history; is it due for a bounce or is there more pain to come?

One of the main themes since the early 2016 rout in financial markets has been “reflation”. Following the deflationary spiral of the previous 18 months, a sharp rebound in asset prices was certainly overdue. But the question on everyone’s minds is whether the rebound over the past 6 months is sustainable or merely a mean-reversion, dead cat bounce. In reviewing the evidence for that answer, it really depends where you look.

Real estate has been a standout among “reflators”. Meanwhile, in the equity market, the post-February rally has been pretty sticky – in the U.S. Elsewhere around the world, it is much less convincing. Across commodities, we again find a lack of homogeneity. Precious metals have continued to shine while energy prices have recently begun to lose their luster. Then you have the agricultural commodities. After a brief bounce this spring, the “ag’s”have come undone again. Today’s Chart Of The Day specifically focuses on the grain commodities, which just registered a dubious milestone.

As measured by the S&P GSCI Grains index, grain prices are now trading at an all-time low.

To be fair, the GSCI Grains Index has only been around since 2007. Even so, an all-time low is an all-time low – and to break the 2008-2009 lows is saying something about the magnitude of the slump in grains. So the reflation read from the grain market would be a resounding “no”. Of course, there are circumstances that are unique to grains that may not carry over in a blanket manner to the other commodities regarding the inflation/deflation issue.

So grains are at their lowest levels of all-time, or at least in a long time. Where do they go from here? Well, we like to stay positioned along with the trend, and it doesn’t take a chart-master to figure out the trend. But will this breakdown to new lows usher in a new leg down in grain prices? Or is it overdue for a bounce?

The thing with major levels like this is that they provide you with an easy road map of how to play it. That is, if prices remain below the breakdown level, it is a clear short, or at least avoid. If prices recover the breakdown level, then longs can be attempted with a stop back below the breakdown point. Which way will this one likely go? We don’t know. But again, we like to stay with the trend so lower would be the safe bet for the time being – again, if prices remain below the breakdown level.

One thing is likely: a big move. A breakdown to all-time lows means there is no recognizable floor underneath the market. Therefore, crashy or air pocket-type moves are always a risk. On the other hand, if prices can recover the breakdown level, the resultant “false breakdown” could spur a substantial move to the upside. After all, if participants cannot sell down a market that has no technical support levels below it, it must be ready to bounce. We have seen plenty of examples of this in recent years, including the false breakdown to all-time lows in gold miners in January that led to the monster rally still underway.

We will say that one possible tailwind for grain prices that may be missing, or at least is not that strong, is the trader positioning in grain futures. VIa the CFTC Commitment of Traders (COT) report, we find that the “smart money” Commercial Dealers are not in as favorable a spot as they were in the spring before they launched that sharp but short-lived rally. At the time, the Dealers were holding either a near-record net long position, or at least a substantially long position in each of the grain markets. At this time, however, Dealer positions are neutral at best among corn and wheat, and even leaning fairly short in soybeans. Therefore, if a false breakdown does transpire, the potential juice behind it does not appear too strong.

Which way will grain prices go from here? We don’t know, but as a firm that prefers to trade with the trend, we don’t want any piece of an asset dropping to new lows. That’s what grain prices are doing right now, along with making a mockery of the reflation advocates.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.