Can Key Level Stop The Bleeding In Health Care Stocks?

The frightful performance of the health care sector could find imminent relief at a key chart juncture – if temporarily.

If there is one sector chart scary enough to merit a Halloween post, it would have to be health care. As we have been warning for some time, the performance of health care stocks in recent months has been a nightmare for investors. Whether it’s biotechs, pharmaceutical stocks, etc., the entire sector has been a bloody mess. However, at some point, things can become so bad that they can’t get any worse. And based upon a potentially key chart level, health care stocks may be reaching such a point, at least in the near-term.

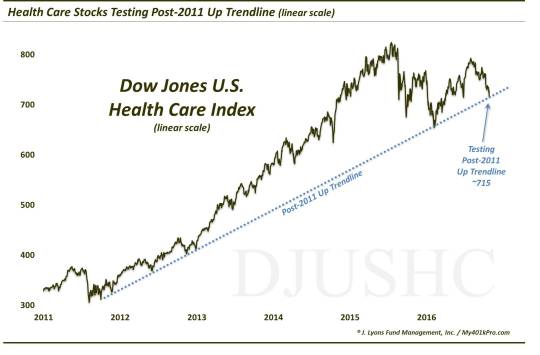

While many important longer-term trendlines have already been broken across the health care space, there is one key line being tested right now that has yet to fail. Looking at a linear chart of the Dow Jones U.S. Health Care Index, its Up trendline since the 2011 lows has been especially prominent. With touches in October and November 2011, June, November and December 2012 and February of this year, the trendline has been more than validated. The fact that the index is presently testing the trendline, near 715, may give health care investors some hope that the bleeding might stop here.

Of course, we did mention that many other longer-term trendlines have already given way, including the post-2008 Up trendline in the NYSE Biotech Index (BTK) and the post-2009 Up trendline in the NYSE Pharmaceutical Index (DRG), both on log scales. Therefore, there has been enough technical damage done across the health care space that this one trendline may not be able to hold up the sector permanently. Not to mention, the DJ Health Care Index has put in a clear lower high on its chart.

However, health care stocks have been so badly beaten down that they are at least primed for a bounce. Therefore, this trendline may, at a minimum, serve as a tourniquet for the bleeding in the immediate-term. That said, the health care “patient” is so sick, technically, that any bounce may merely be a selling opportunity.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.