Stock Rally All Just Fun And Games Now

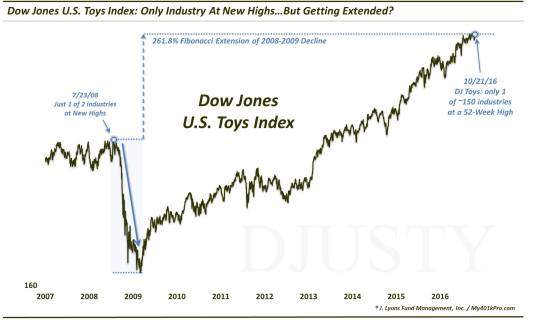

Despite the recent resilience of the major averages, the only market segment residing at new highs on Friday was the Toy industry.

Following more than 7 years of a cyclical bull market, it’s not unusual to hear quips (at least from the bears) along the lines of “the stock market is a joke”. Now, the stock market is going to do what it’s going to do, whether we think it is rational or not. Therefore, to get sucked into the “market is wrong” line of thinking is a counterproductive endeavor. That said, whether it pertains to

the market’s veritable anti-gravity tendencies in recent years, the recent, unprecedented central bank intervention or the seeming return to amateur hour among fund managers and market participants, we can certainly agree that various aspects of this market seem a little funny. However, we can now add a factual argument to the idea that the market rally is all just fun and games.

That’s because, as of Friday, October 21, of the roughly 150 Dow Jones U.S. equity industries that we track, just one was at a 52-week high: the DJ U.S. Toy Index.

Now while this development makes for interesting trivia fodder and a clever and punny headline (which we admittedly enjoy!), there are a few serious upshots worth mentioning here.

First off is the fact that this development speaks to the thinning nature of the market rally presently. Sure, the major averages are off their highs somewhat (e.g., down 2.3% for the S&P 500 a/o Friday), however, there are typically a handful of industries that will still be hitting highs. This is just cherry-picking, but on May 24, for example, the S&P 500 was 2.4% below its 52-week high, yet there were 8 DJ industries that registered a 52-week high. So the breadth of leadership seems to be lacking at the moment.

On a related note, this may certainly be anecdotal, but we did find one other day in which the DJ U.S. Toy Index was just 1 of 2 industries hitting a 52-week high. That date was July 23, 2008. Of course, the S&P 500 would not rally even as much as 2% following that date before getting chopped in half over the next 6 months. Now, we are not suggesting that the market is on the verge of any similar type action. However, the relatively thin conditions surrounding this all-time high in the Toy sector is perhaps not healthy.

Lastly, despite the impressive run that the Toy industry has enjoyed since the 2009 lows (up some 350% over that time, with roughly half of it coming in the last 2 years), it may be getting extended. At least according to one analysis. Fibonacci Extension analysis is a mathematical tool that measures the magnitude tendencies of price range reversals (see this post that nailed the top of the pharmaceutical sector for an example).

In this case, from 2008 to 2009, the DJ Toy Index dropped nearly 60%, from around 400 to around 170. By 2013, the index had rallied back above the 400 level and began to extend upwards out of the 2008-2009 range. Fibonacci Extensions mark various magnitudes of extension, e.g., 161.8%, 261.8%, etc., that markets often experience once breaking out of a former range. In the case of the Toy Index, roughly 777 marks the 261.8%extension of the 170-400 range. The index closed at 779 on Friday, and in fact, reached a high of 773 3 months ago. So it has struggled to make any meaningful progress since attaining this 261.8% Extension. Now, these Fibonacci levels are just guidelines, not iron clad levels. However, they are consistent enough, combined with our overall market risk assessment, to warrant some caution here.

At first blush, the headline of this post – and its subject matter – may seem like a humorous sidebar to the serious task of market research. However, the solitude of the Toy industry’s 52-week high, along with its close proximity to potential resistance is no laughing matter. Should the negative implications suggested by these developments play out, it certainly won’t be fun and games for investors.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.