Bullish Bond Boat Back In Balance

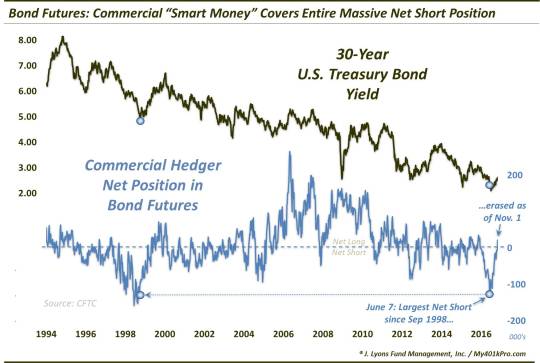

The massive “smart money” bond short has been completely unwound.

In late June, we wrote a post suggesting why perhaps the long-term, and long-doubted, bull market in bonds could be in jeopardy. The thesis admittedly revolved substantially around anecdotal evidence pointing to a new-found bullish consensus toward bonds. But after at least a decade in which most market participants thought the only possible path for interest rates was higher, the widespread resignation to “lower for longer” seemed to be a watershed change of opinion. And that change of consensus opinion was what we believed could pave the way for a long-term reversal in interest rates.

In the shorter-term, it was an objective piece of evidence that pointed to the upside being the path of least resistance for rates. Specifically, from the CFTC’s Committment Of Traders (COT) report on futures positioning, we noted that Commercial Hedgers had just moved to their largest net short position in Treasury Bond futures in 18 years. And as we continued in the post,

“Commercial Hedgers have been given the moniker of “smart money”. This typically brings about plenty of questions and confusion when we discuss this topic. It is not that these Hedgers are always right, or smart. They do what their name implies, i.e., hedge. They are, again, taking the other side of positions held by Non-Commercial Speculator firms, e.g., commodity funds, hedge funds,etc.

These Speculators are typically trend-followers so they will generally add to longs as prices rise and add to shorts as prices fall. Therefore, the Hedgers will build up positions counter to the prevailing trend. Thus, during a long trend, Hedger positioning can be on the wrong side for a long time, and to a great extent. However, the reason for their “smart money” reputation is that at critical turning points or junctures in an underlying contract, they will most often be positioned correctly for the turn. And the more significant the juncture, often times, the more extreme their (correct) positioning will be.

In this case, these, so-called “smart money”, Commercial Hedgers have their largest net short position in bond futures in 18 years (meaning Speculators are at their most bullish). Incidentally, the last time Hedgers were net short more than 100,000 contracts was in September 1998, just as bond yields were breaking below a 5-year floor to plumb 30-year lows. Within days, the TYX would form a low around 4.10% that would hold for the next 4 years.

2 weeks after that post, 30-year yields would bottom out around 2.10. For the last 4 months, they have been on the ascent and, as noted last Wednesday, are currently testing resistance up near the 2.65% level. The impetus for this post is to note that, after the 4-month rise in rates, Commercial Hedgers had covered the entirety of their massive net short position.

Again, this means that Speculators, who are on the other side of the Hedgers’ position, have seen their historically large net long position from four and a half months ago entirely erased. This doesn’t mean that rates automatically need to fall and bond prices rise. Hedgers have merely returned to a neutral position following their epic short-covering. It is possible, then, that this recent trend of rising yields continues until Hedgers have adopted a substantial net long position.

However, a pause or reversal would certainly be consistent with last week’s chart breakdown highlighting the nearby potential resistance in yields. At a minimum,

given the now-balanced positioning in the bond market, what was a substantial headwind for bonds just 4+ months ago is no longer the case.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.