Buzz Could Wear Off This Hot Commodity

The rally in coffee prices could soon be facing some headwinds.

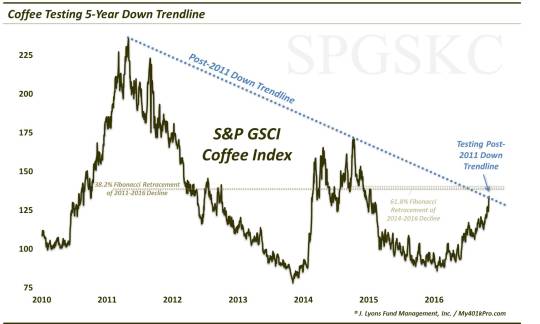

This year has been a favorable one for many commodities. Included among them is coffee with prices up some 50% for the year and hitting 20-month highs. Despite this, and despite the fact that we are staunch believers in the concept of relative strength (i.e., sticking with the up-trending markets), there are circumstances currently that make us suspect of continual upside in coffee over the near-term. One is the fact that prices are hitting the 5-year Down trendline (on a linear scale) stemming from the highs in 2011 and connecting the tops in 2014, demonstrated here by the S&P GSCI Coffee Index. Additionally, there is potential price resistance just above via Fibonacci Retracements stemming from the 2011 and 2014 highs.

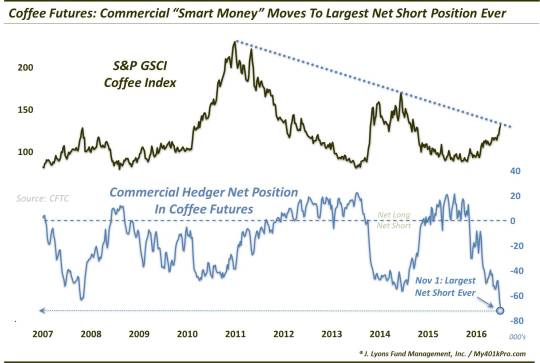

This potential price resistance may be enough to halt the coffee rally temporarily, even if it does not derail it longer-term. However, there is another factor that may be a more substantial headwind should some selling commence. According to the CFTC, Commercial Hedgers in coffee futures are holding their largest net short position in the history of the contract. The concern is that these Hedgers most often represent the “smart money” once positioning gets to an extreme. Thus, this record net short position indicates a potential negative for coffee prices, should they begin to reverse lower.

Now these factors don’t guarantee an end to the coffee rally. If prices spike right through the chart resistance, the potential headwind represented by an unwind of futures positioning won’t likely be triggered yet. However, we do have a recent, almost carbon copy, example of a similar situation in natural gas prices.

Just 3 weeks ago, nat gas was running up against its own 8-year Down trendline with a near-record Commercial Hedger net short position. As we have updated recently on Twitter and Stocktwits (@JLyonsFundMgmt), nat gas has lost nearly 25% in just the 3 weeks since. Circumstances in the coffee market could put a similar chill on the coffee rally.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.