Pharma Phall Phinding Phulcrum?

Beleaguered pharmaceutical stocks have hit our targeted downside level that could inspire a bounce, at least.

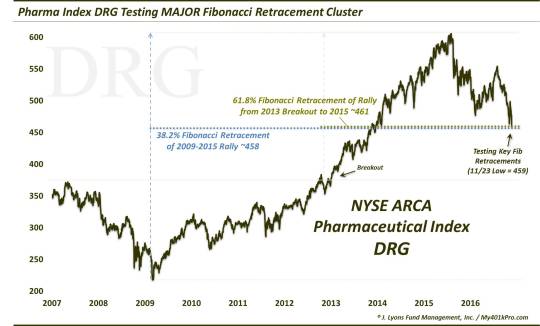

Just as there are leading stocks, sectors, etc. on the upside, so too are there leaders to the downside. And in recent months, one of the downside leaders (or, losers) has been health care stocks. We have been very vocal about the sector’s status as the market’s least attractive area. In particular, we have noted several times the risk especially in the pharmaceutical space, beginning at the peak in July 2015 as well as this past September and October. But while pharma stocks have led the sector downward, if they are able to find a price level significant enough to put a halt to their decline, they may be able to lead a resurgence in the sector. This morning, the NYSE Pharmaceutical Index (DRG) hit such a level that we earmarked long ago.

Continuing our recent series on the technical makeup of key market price charts, today we look at the DRG hitting a level of significant potential support around the 460 level. We have been watching this level for a long time as a potential fulcrum, or pivot spot for the DRG, and, perhaps, the health care sector.

As the chart illustrates, a couple key levels converge in the vicinity of current prices. Most importantly is the confluence of 2 key Fibonacci Retracement levels:

- The 38.2% Fibonacci Retracement of the 2009-2015 Rally ~458

-

The 61.8% Fibonacci Retracement of the Rally from the 2013 Breakout (above 2007 highs) to the 2015 top ~461

In our view, this confluence of Fib Retracements represents the key spot to hold for the DRG. As we have mentioned in recent posts, a convergence of several Fib Retracements validates the levels from which we’ve chosen to measure them. It also gives us increased confidence in the relevancy of the level at hand. To boot, the 455 area also marks the 2000 peak in the DRG which held until late 2013.

This morning, the DRG fell 2%, bottoming at 459, before bouncing all the way back to close unchanged. This area should at least serve to stop the immediate bleeding in pharma stocks, and perhaps spur a reversal in the health care sector in general.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.