Cocoa Could Make For A Sweet Last Minute Gift

Speculators have turned net-short on cocoa futures for the first time in years – just as prices are testing major long-term support.

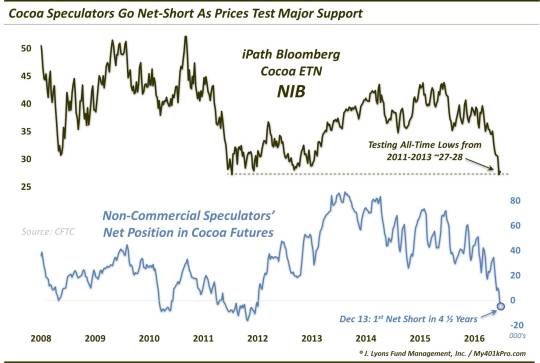

If you’re still looking for last minute gift ideas for that trader on your list, a few shares or contracts in cocoa may do the trick. That’s because the sweet commodity may be well-positioned for a bounce following a 12-month rout. First, let’s look at prices as determined by the iPath Bloomberg Cocoa Subindex Total Return SM Index ETN, ticker, NIB. NIB is presently testing the 27-28 level that represents the fund’s all-time lows set in 2011-2013.

Even if this 27-28 level eventually gives way, one would expect it to hold at least temporarily given that this is the first test of the level in almost 4 years.

Another thing cocoa has going for it, especially if prices are able to hold here and begin to bounce, is the current positioning among cocoa futures traders. From the CFTC’s Commitment Of Traders report, you can see on the bottom half of the chart that for the first time in four and a half years, Non-Commercial Speculators have moved to a net-short position.

These Speculators, who are made up mainly of commodity and hedge funds, are primarily trend-followers meaning the more prices trend in one direction, the bigger the position that they will adopt. That’s all fine and well as long as the trend continues. However, these Speculators are also notoriously wrong-footed at major turning points, especially when positioned to an extreme. And while they have had larger net-short positions in the past, since this is their first net-short in 4 and ½ years, it certainly represents an extreme in recent years.

Furthermore, net-short positions have not worked out well for Speculators in the past. Net-short positions in 2008, 2010 and 2012 preceded rallies in the NIB of 37%, 67% and 35%, respectively, though the 2010 version did take a few months before a rally kicked in. If prices are able to hold the support level mentioned and begin to tick higher, it will put pressure on the Speculators to cover their shorts and begin adding to the long side. This should serve to perpetuate any budding rally in cocoa prices.

So if you need any last minute gift ideas for your trader friend with a mean-reversion bent, the setup in cocoa looks potentially pretty sweet right now.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.